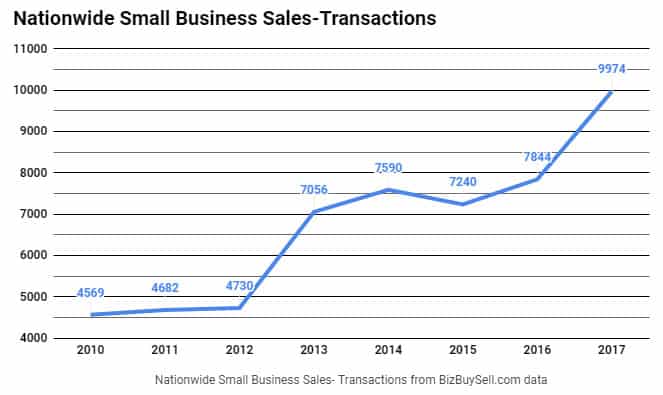

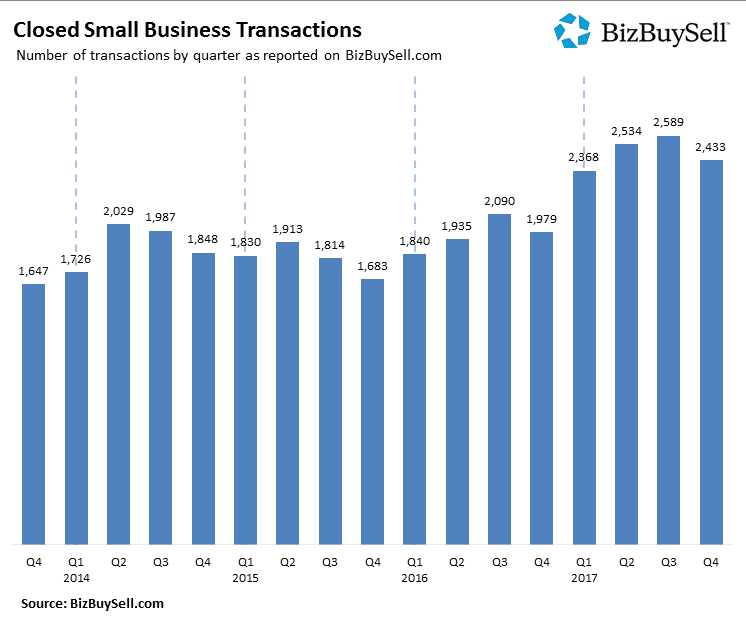

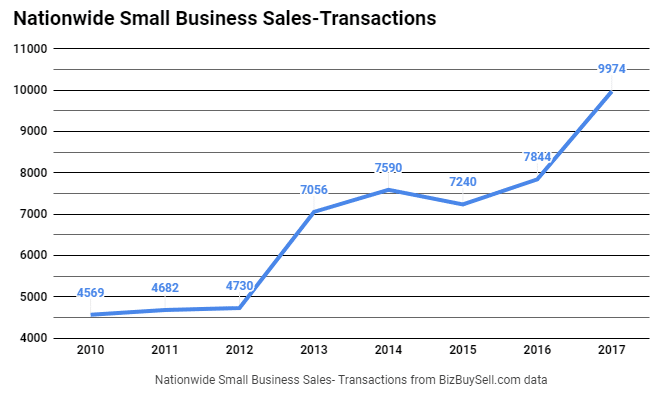

2017 was a record year for sales of small businesses to entrepreneurs and investors with transactions increasing by 27% over 2016 nationwide according to the annual BizBuySell Insight Report just published. Orange County business sales were up 19% from 2016 with 285 businesses sold. It has been a great time to sell your small business over the past 24 months and every indication is that 2018 will be another record breaking year.

During the Great Recession of 2008-2009 business sales dropped dramatically, in fact much more so than real estate and other markets. Business sales started their rebound in 2013 and has produced steady growth since 2016 achieving record numbers of closed transactions and again in 2017 breaking record numbers with 27% increase over the previous year. Looking back further, 2017 small business sales were double the annual transactions closed in 2012 with a 110% increase from 2012 to 2017.

Business sales have seen record growth nationwide and Orange County is no exception. At the end of 2017 there were 621 Orange County businesses listed for sale on BizBuySell, 2,118 in Los Angeles County and 355 in San Diego County. Orange County business sales (closed transactions) were 285 in 2017, with Los Angeles County ending the year at 764 and San Diego at 158.

You may notice the large difference between businesses listed and closed transactions. Many businesses listed on public websites do not sell for a variety of reasons. Some are simply overpriced, some are distressed and not sellable, and sometimes the seller’s situation changes. Another factor is businesses listed as for sale by owner vs those represented by a professional business broker. Business brokers have much higher closing ratios for the businesses they represent as they are trained and experienced in business valuation, marketing, and most importantly how to structure a transaction as well as negotiations (putting a deal together). Our closing ratio averages 85% of the businesses we represent are sold.

What’s Driving Record Business Sales-Transactions?

During the Great Recession business sales plummeted, not from a lack of business owners wanting to sell their businesses, but as a result of company earnings dropping and SBA financing becoming very difficult to obtain. Consequently, business values dropped and sellers just weren’t willing to sell their business at the low valuations, they simply chose to wait for the economy to improve. And in 2013 that is exactly what happened.

As the economy started to rebound in 2013 and picked up momentum in 2015, businesses started to grow again and their earnings grew as well. SBA lending loosened up, and with the improved earnings banks were once again willing to lend to small businesses. Many business owners are Baby Boomers that have owned their businesses for 20 or even 30 years and they have been waiting to retire. With the improved economy and lending environment, that time is now and there is a large pool of buyers from younger generations eager to buy businesses.

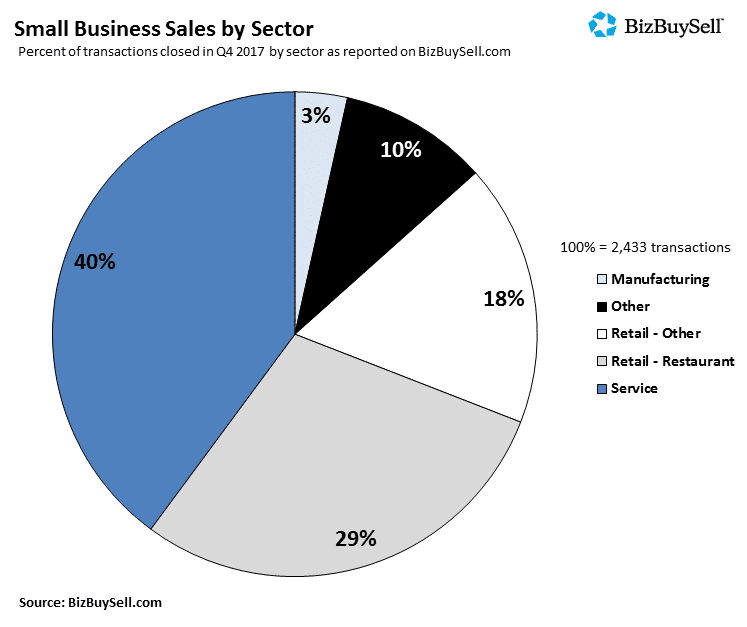

Small Business Sales-Transactions by Industry

Service sector businesses represented 40% of the businesses sold in 2017, followed by Restaurants at 29%, Retail at 18% and Manufacturing at 3%. If Restaurants and Retail were lumped together they represent 47% of total business sales in 2017.

Service businesses include a wide variety of businesses and are not just personal or professional services such as hair salons and CPA’s. Service businesses include companies providing services such as disaster restoration, website development, computer-IT firms, marketing companies, and many e-commerce companies, which explains why service sector sales represent 40% of total transactions.

One can’t help but notice that Manufacturing represents just 3% of aggregate total business sales in 2017. While this seems anemic, one must consider the fact that typical manufacturing transactions are a much higher transaction value and the data shown here is the number of transactions. Of course there are far fewer manufacturing businesses today than 20 years ago, however, they tend to be much larger businesses, with more employees, and they sell for higher values and much higher earnings multiples.

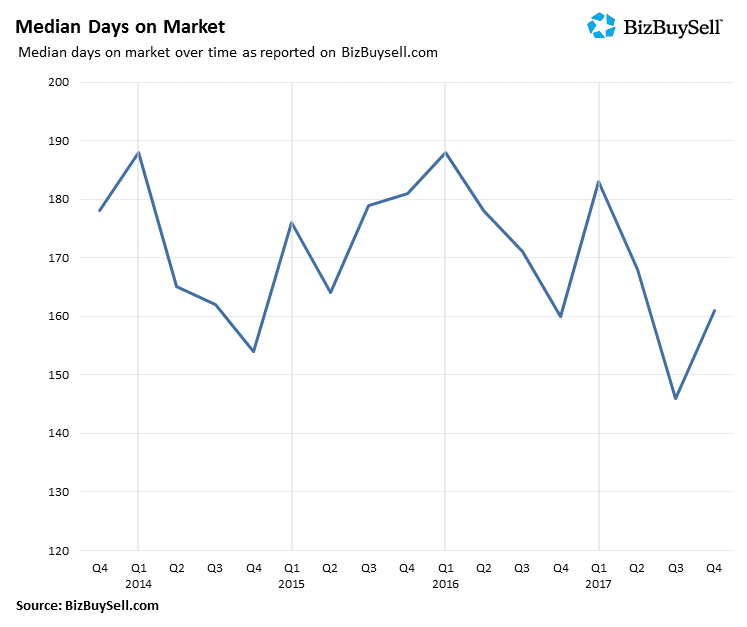

Business Sales Average Time on Market

Average time on market has gone down slightly from 190 days to 160 days. One has to keep in mind this is the median or average time on market and the time on market is driven largely be the asking price, size of business, and type of business.

For example, businesses earning over $250,000 have much more demand than those earning less than $100,000. Likewise, service businesses sell much faster than a brick and mortar retail business and larger transactions take much longer than small transactions.

It’s a great time for business owners to sell their businesses and reap the maximum benefit from the increased growth in the current economic climate.