In 2017 the number of businesses being sold increased 27% over 2016 according to Bizbuysell. Who is buying businesses today and what can a seller expect when a buyer is considering making an offer?

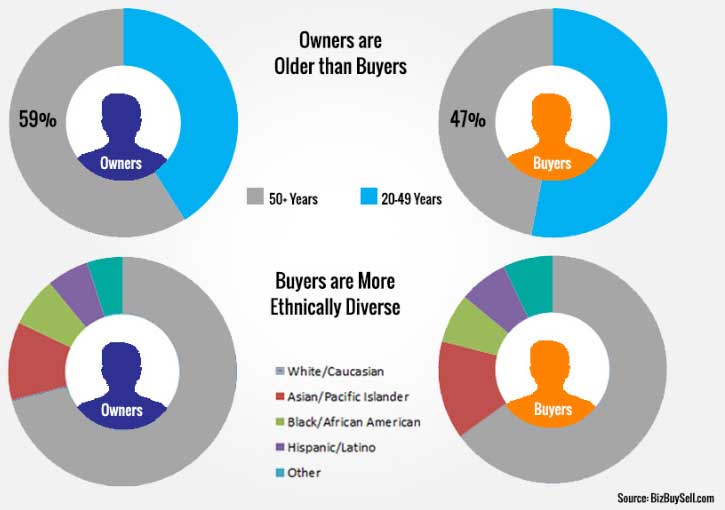

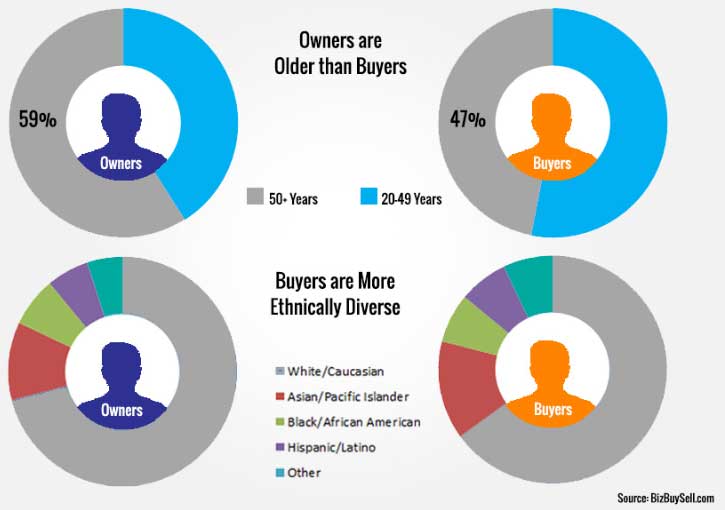

The buyers of today are on average younger, ethnically diverse, intellectually savvy and are willing to pay for the value of a business or what the business is worth if they can be shown how the value makes sense. In other words, today’s business buyers are smart and well-informed.

Working with a business broker in today’s market places sellers of small business at an advantage. A professional business broker will perform a free business market valuation for your business based on your financial statements combined with comparable sales data (comps) to arrive at a market value that maximizes the seller’s proceeds and at the same time demonstrates to a buyer the value of your business.

Being able to navigate today’s buyer pool is important. The buyers are inquisitive, cautious of the value they are receiving for their investment, and asking more questions in regards to the integrity of the finances, operation, customer base, equipment, staffing and market position of the business. A seller can expect to have many questions asked before an offer is made. A good business broker is prepared to answer the questions building a relationship and trust with an interested buyer and at the same time arrive at an optimum offer for both buyers and sellers that will achieve the sellers goals and provide the buyer with a good fit for future success.

The majority of buyers are leveraging the investment they are making, very rarely will a buyer offer all cash. Seller financing is one way to achieve that goal however, SBA financing allows a seller to cash out and offers better terms for the buyer than a seller can provide. Business brokers that have relationships with SBA lenders and are familiar with SBA financing are an advantage to both the buyer and seller. Having the business approved by an SBA lender makes your business more marketable as a result of the low down payment with an SBA loan and 10 year financing.

Today’s buyers are educated and motivated, sellers definitely have a strategic advantage navigating the diverse landscape of today’s market with the knowledge and expertise of a professional business broker.

At Pacific Business Sales we know how to market your business to today’s buyers, contact us for a Free Market Valuation for your business and no no-obligation meeting to discuss the prospective sale of your business.