As business brokers the first question we get from business owners is “How much is my business worth”, immediately following that, the second question is “How can I minimize the taxes on the proceeds?” We are not CPAs, tax or financial advisors, but over the years we have developed relationships with some of the best CPAs and financial advisors in the business, and along the way we have found a number of tax strategies to minimize taxes on the sale of your business. One such tax strategy is the Deferred Sales TrustTM.

First, let’s look at what happens if you do nothing and just sell your business. Depending on the structure of the sale of your business your taxes capital gains tax could be as low as 15% to 20% if the business is sold as a Stock Sale and if the business is sold as an Asset Sale a portion of the proceeds could be taxed as ordinary income (ouch!). Exactly how your proceeds will be taxed unfortunately is not a simple question and you will have to review this with your CPA or tax advisor to determine exactly what your taxes would be. Regardless, when you sell your business, you will be paying significant taxes unless you take action in advance and implement a tax strategy.

Now let’s look at what you can do to minimize the tax liability when you sell your business. Before we dig into what works, a word of caution, there are a number of “tax strategies” that have been created and the IRS has recently ruled that several are not legal or valid. For the sellers that used these now overruled strategies they are facing the full taxes on the sale of the business plus penalties and it is now too late to implement another tax structure. So it is critical that if you chose to use a tax strategy you review with it your CPA or tax advisor. There are two tax strategies to minimize taxes on the sale of a business that have survived IRS scrutiny over the years, one is the Charitable Remainder Trust (aka CRT) and the other is the Deferred Sales TrustTM (DST). The CRT is more complicated, so for this example, let’s just look at the DST. Here’s how the DST works.

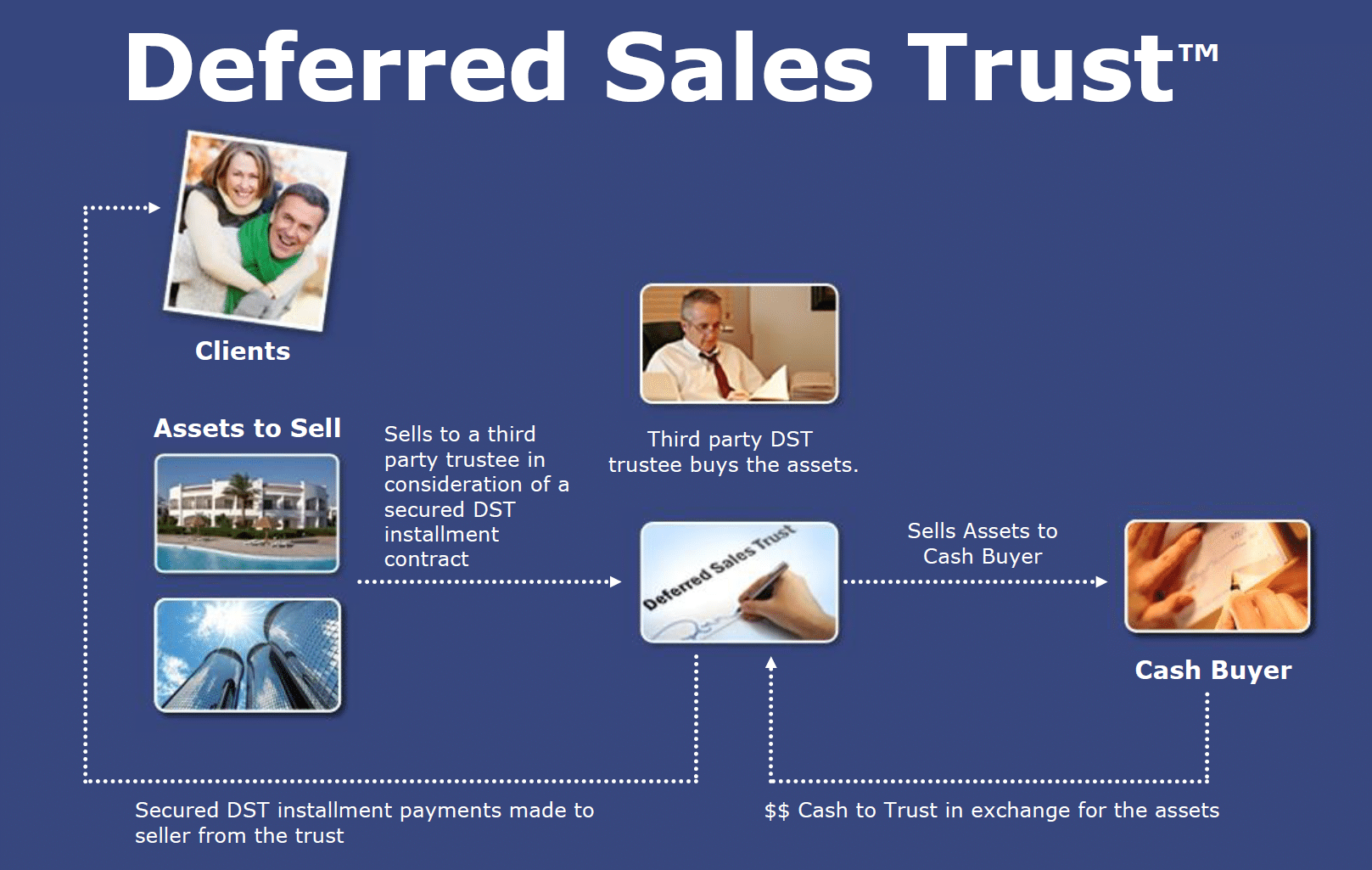

The DST defers the proceeds of the sale of your business by putting the cash into a trust. Thus you do not pay taxes on the full amount of the sale and only pay taxes as the proceeds are taken out of the trust. You can choose how much you take out of the trust each year and the term of the trust to fit your needs. The structure of this is much like a Seller Note or Installment Sale where with the DST the seller transfers the assets of the business to the Trust before the close of escrow and the Trust issues a Note to the Seller for the purchase price of the business. The Buyer then purchases the business from the Trust and the cash is sent to the Trust (no taxable event has occurred for the Seller). The Seller has complete control of the funds in the Trust and can direct the financial advisor to structure the investments as they wish. The Seller can also determine how much cash is taken out of the Trust, the timeline for these payments and can change the payment schedule if they wish. Taxes are paid as the funds are taken out of the Trust.

The diagram below illustrates how the DST works.

We mentioned above that several tax strategies have recently been overruled by the IRS. The DST has been in use for nearly 20 years and in 2009 the IRS issued a Private Letter Ruling on the DST which validates this tax strategy.

For more information on the DST you can use our DST calculator to estimate tax savings on your own and request a complimentary analysis and consultation with the tax advisor we work with, Darren Morrow at Morrow & Company CPAs.

Disclaimer

Pacific Business Sales, it’s Broker and Agents are not financial advisors and are not providing financial or tax advice in this informational blog. Before implementing any tax strategy or tax planning you should obtain the advice of your CPA or tax advisor.