It seems like selling a business with (through) a Business Broker would be relatively straightforward, one would think that you would just do a Google search for Business Brokers, pick one, put the business on the market, the broker goes to work and presto your business is sold.

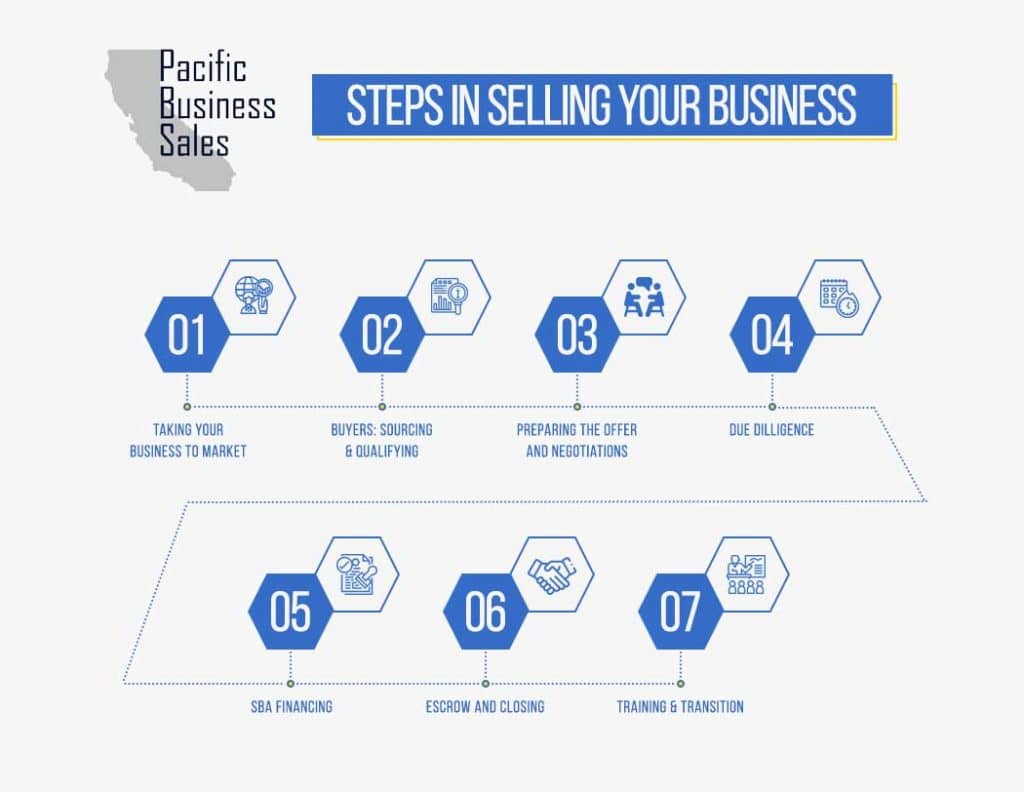

It’s not that simple. To successfully sell your business there is a lot to do including; preparing the business for sale, finding the best right business broker, working with your broker while the business is on the market, due diligence after an offer is made, closing, and then training-transition.

3 Things To Do Before You Put Your Business on the Market

If you are not ready to put your business on the market now, and have time to prepare, here are some things that will increase the value and marketability of your business. Also see our blog 7 Steps in Preparing Your Business for Sale.

- Financial Statements

Meet with your CPA to review your financial statements. Your business value will be calculated using the last 3 years tax returns to calculate the Discretionary Earnings (DE).

Simply put, DE is the Net Income from the tax returns + Owner’s Salary + Owner’s Benefits/expenses (non business essential) + Interest + Depreciation + Amortization. When you meet with your CPA make sure all of your owner’s benefits/expenses are well documented and expensed on the tax return (if they are not on the tax return they cannot be added back for the DE calculation). Also make sure your financial statements are consistent and well documented.

- Focus on Revenue & Profitability

Your business will be valued based on a multiple of DE (Discretionary Earnings). Thus for every dollar of profit or DE you add to the bottom line you will create roughly an additional $2 to $3 in value.

When preparing your tax returns keep in mind that by minimizing profits on your tax returns you are also minimizing the value of your company. For example, if you reduce your reported profits by say $10,000 you will probably save $2,000 to $3,500 in taxes and feel pretty good about it. On the other hand, if you were selling your business that $10,000 reduction in net profit reduced the value of your business by $20,000 to as much as $35,000. So in broad terms, for every dollar you save on your taxes by reducing profits you lose $10 in value and once the tax returns are filed this cannot be undone.

There are ways to minimize profits and taxes without affecting the value of your business. One way is through retirement plans, other ways include owner’s expenses such as auto, travel, meals, and insurance increasing owner’s benefits. These expenses reduce net profit and thereby taxes, because they are an owners benefit they are added back in the calculation of Discretionary Earnings (DE) which is the earnings figure used to calculate business value.

Spring Cleaning

The appearance of a business makes a difference with buyers and the marketability of the business. Of course an industrial business, machine shop, construction company, etc is not expected to look like the offices of a white collar high tech company, but the business should be organized, clean, and look professionally run.

When a buyer sees a warehouse or shop that is cluttered and disorganized this makes an indelible impression as to how the business is run in general. Likewise, if the business is well organized and has a professional appearance this makes an important impression with respect how the business is run.

Choosing the Right Business Broker

Selecting the right (best) Business Broker to sell your business is perhaps the most important step in selling your business. We’ve outlined 9 things to ask your business broker before making your choice below, also see our blog How to Choose a Business Broker for more information.

- Full Time Licensed Professional Business Broker:

In California and many other states Business Brokers are required to have a Real Estate License. Also make sure they are a full time Business Broker and not dabbling at selling business on the side. - Experience:

Ask about their experience. Depending on the industry and the complexity of the transaction a Business Broker should have years of business sales experience and have an understanding and be conversant in regards to your business. It is important to select a Business Broker that knows when a Stock Sale is needed and when it is not and how to do both types of transactions. It is equally important for your Broker to have excellent lender relationships and be knowledgeable about SBA financing. And finally you will be relying on your broker to screen and talk with buyers guiding them through the process. You will want to ensure your Broker indeed does this with buyer inquiries. - Upfront Fees:

Ask if they charge any upfront fees. Our firm, Pacific Business Sales, does not charge upfront fees. Our commission is paid at the close of escrow through the Sellers proceeds. - Professional Organization Memberships:

Are they a member of CABB (California Association of Business Brokers) and/or the IBBA (International Association of Business Brokers)? - Examples of Marketing:

Ask how they will market the business and ask for examples of what they send to the buyers after they have signed an NDA. While our firm prepares a comprehensive Confidential Information Memorandum (typically 20 to 30 pages), it is fairly common for Business Brokers to prepare a one or two page summary for the business and that’s it. Ask for examples of their work and how your business will be marketed. - Transaction Process:

Ask the Business Broker to explain the transaction process and ask if they work with SBA lenders. See our Our Steps in Selling a Business - Confidentiality & Buyer Screening:

It is important that the sell of your business remain confidential while the business is being marketed to various buyers. Ask your Business Broker how they handle confidentiality. Screening buyers helps with confidential information being distributed to only those buyers who qualify for the business acquisition. Buyers are also screened in order to minimize time wasted for all parties involved. It’s best to have your Business Broker interview an interested buyer prior to meeting with a seller and field initial questions. - Purchase Offer:

Ask about how the purchase offer will be handled. Do they use an LOI (letter of intent), a custom (in-house purchase offer) or a standard purchase offer? At Pacific Business Sales we use the CABB Purchase Agreements and associated documents and the CABB LOI. There are many problems and risks with a custom LOI. LOIs typically are non-binding and often leave out many key deal terms that need to be negotiated later, and should be reviewed by your attorney before you accept it since it is a non standard legal agreement, which will result in a legal expense to you. There are similar problems with custom in-house purchase agreements. Since they are not an industry standard form and were created by the Business Broker’s firm independently or the buyer’s attorney you should have this reviewed by your attorney, there are risks with non standard contracts and they may not be as comprehensive as the CABB agreement. The problem with custom or non standard agreements is often not what’s in the agreement as much as what’s missing and knowing if the agreement was done properly. - Trust:

It is important to build trust with your Business Broker, you can start by looking at their online reviews, ask for references and be comfortable with how they conduct their business valuation of your business.

It is common for business brokers to use broad “rules of thumb” or free comps (comparable sales) data from business for sale websites for valuations. These methods are acceptable for very small businesses such as restaurants and retail but they are not accurate for larger businesses or for industries such as manufacturing, technology, Healthcare, construction, etc.

At Pacific Business Sales we use Peercomps for our business valuations. Peercomps is a paid professional business valuation program using the same valuation methodology employed by business appraisers/valuation analysts. The comparable sales data in Peercomps is from actual closed SBA financed transactions and the business appraisal from those transactions. We have found that the Peercomps valuation software and database is very accurate and our valuations closely match the appraisal value when our transactions go into underwriting for SBA financing.

3 Things to Do While Your Business is On the Market

- Revenue and Profitability:

Maintain revenue and profitability. This is very important while your business is on the market. A business can take anywhere from three months to one year to find a willing qualified buyer. If the revenue drops the Discretionary Earnings follow and these factors will reduce the price you will be able to obtain for your business at the time of offer. - Don’t Lose Focus:

It’s not the time to take your foot off the gas or take extra vacations. A loss of focus will result in decreased revenue and lower profitability affecting DE which again will result in a price adjustment. - Changes:

Any significant changes that occur in your business while it is on the market let your Business Broker know about:

Staff and Equipment changes, addition or cancellation of any major contracts and/or customers, new workman’s comp claims, new lease terms, significant industry changes, a drop or increase in sales revenues.

Keep your Broker well informed of changes and the status of your business.

After an Offer is Made

- Due Diligence:

Due Diligence is one of the most important times in the sale of your business. The buyer is going to want to verify that the business is what it was represented as at the time of the offer. This is where the real work begins. The buyer will request various items, see our Blog Preparing for Due Diligence on the Sale of Your Business. - Escrow:

After due diligence is completed and signed off it is time to open Escrow. Escrow instructions will be sent out to both buyer and seller. Escrow typically takes 30 days and the clock does not start ticking until Escrow receives the signed Escrow instructions from both parties with the deposit check from the buyer. - Continuity:

After an offer has been accepted, Due Diligence is complete and escrow is open it is easy to become complacent and feel like “phew, I’m done”. In one sense the major hurdles have been cleared but you’re not done yet. It is vital to keep the business running well, just as if you haven’t sold it. If the business has a decline in sales, loses a major customer or some other significant negative event happens, before the close of escrow, while you are still running the business this could cause the deal to fall through. The purchase agreement has a clause about Continuity which specifies the seller is responsible for continuing to operate the business in the usual way and protect and preserve the assets and goodwill. Simply put, the seller is responsible to ensure the business continues as normal.

INFORMATION ON BUYING-SELLING A BUSINESS

- How to Secretly Sell Your Business

- Steps in Buying a Business

- Steps in Selling a Business

- “Own Your Future, Straight Talk about How to Buy a Business and Build Your Future” by Bill Grunau

- Stock vs Asset Sale in the Purchase – Sale of a Business

- FAQs Buying a Business

- FAQs Selling a Business

- SBA Financing