Selling a business is not a small decision. There are a number of things to consider when you think about selling your business. Perhaps, it took you a while to get to this decision point. Now that the time has come, you may not even know where to start. How to sell my business is a question that has come to your mind now that you have made the decision to take that next step. Your choice is ultimately a personal one, and at Pacific Business Sales, we are here to guide you through the process. The next time you wonder how do I sell my business, you will know what to do before, during, and after the sale.

How to Sell My Business: How to Prepare Before Selling

Preparing for the sale is crucial when it comes to selling your business. This stage involves several important steps that will set the foundation for a successful and smooth transaction.

Evaluating Your Readiness to Sell

Before diving into the selling process, it’s important to assess your personal and professional readiness to sell your business. Consider factors such as your motivation for selling, your future plans, and the potential impact on your employees and stakeholders. This evaluation will help you determine if now is the right time to sell and if you are mentally and emotionally prepared for the transition.

Preparing for Financial Statements and Documentation

Financial transparency is key to instilling confidence in potential buyers. Prepare detailed financial statements, including income statements, balance sheets, and cash flow statements, for at least the past three years. These statements should accurately reflect the financial health of your business. Additionally, gather other relevant documentation such as tax returns, contracts, leases, and legal agreements. Organizing and updating these documents in advance will expedite the due diligence process and demonstrate professionalism to buyers.

Assessing the Value of Your Business

Understanding the value of your business is crucial for pricing it appropriately and attracting potential buyers. Engage with a professional business broker, like Pacific Business Sales with experience in valuing businesses to assess the fair market value. The financial documentation above will assist with this process. A professional will consider various factors, such as financial performance, assets, liabilities, market conditions, comparable industry multiples, and industry trends, to determine the estimated value. This assessment will provide you with a realistic range for setting your asking price.

Financial Planning for Maximizing Profits

When it comes to selling a business, exit planning can play a crucial role in helping business owners defer taxes and maximize profits. By carefully strategizing and implementing effective tax deferral strategies, entrepreneurs can minimize the immediate tax burden associated with the sale and keep more of their hard-earned money. Additionally, by incorporating various options such as the use of trusts, charitable contributions, or qualified retirement plans, business owners can further optimize their tax position. Engaging in comprehensive exit planning prior to the sale of a business can provide owners with valuable insights and strategies to minimize their tax obligations, ultimately allowing them to secure a stronger financial future. An effective financial planner that specializes in exit planning can assist a seller far in advance of the listing of the business. Pacific Business Sales would be happy to provide a list of trusted professionals if you do not know of a financial planner with this specialization.

How to Sell My Business: What Happens During the Transaction

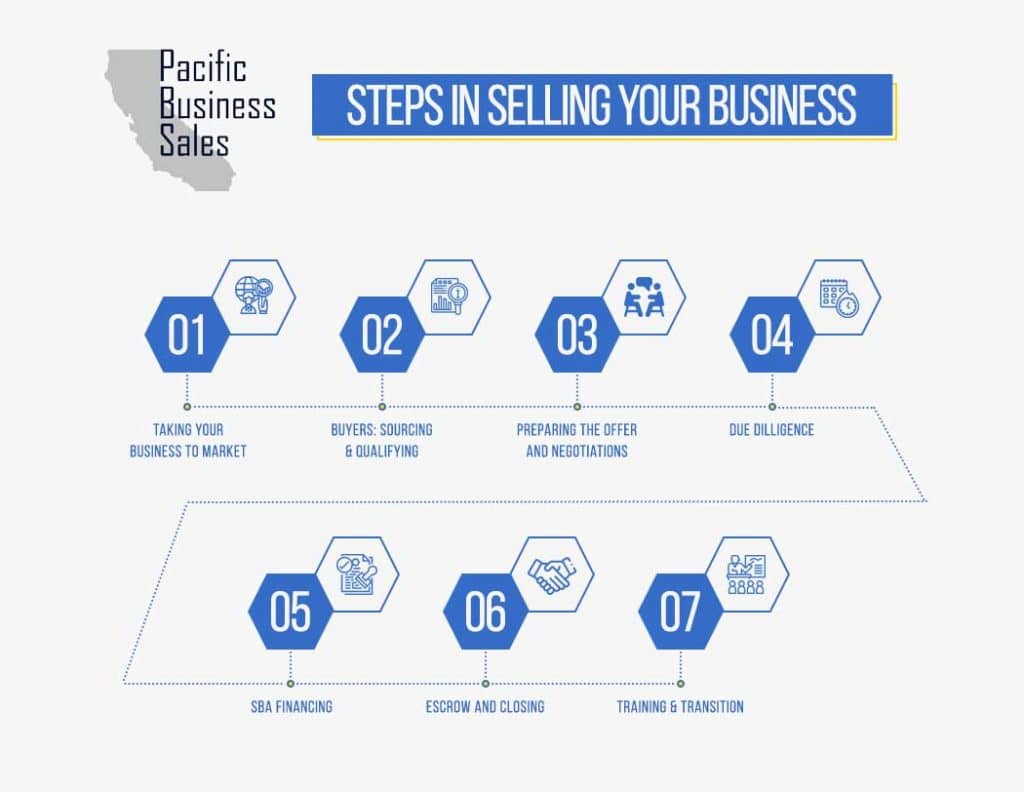

During the transaction phase of selling your business, there are several important activities and considerations to keep in mind while you’re in this crucial stage.

Offers: Once you have identified potential buyers and received offers or letters of intent (LOIs), it’s time to negotiate the deal terms. This involves discussing and reaching agreements on various aspects such as the purchase price, payment structure, non-compete agreements, transition period, and any contingencies or warranties. It’s important to maintain open communication with the buyer through your business broker and be prepared for some back-and-forth negotiation.

Purchase Agreement: Once the terms of the offer are finalized, the next step is to finalize the purchase agreement for the sale. Pacific Business Sales can draft the necessary agreements, such as the purchase agreement, asset transfer agreements, and any other contracts or legal documents required for the transaction. Please note that Pacific Business Sales is not an attorney and therefore it is recommended that each party have their legal counsel review the purchase agreement.

Due Diligence: Once an offer is accepted, the due diligence periods commences. This is a comprehensive investigation of your business’s financial, operational, legal, regulatory, and commercial aspects to validate the information provided and assess any potential risks or liabilities. Be prepared to provide the necessary documentation and information requested by the buyer’s team. Maintain transparency throughout the process and address any concerns or issues that may arise.

Escrow: After due diligence is completed escrow is opened and the next focus is to shift the practical aspects of transferring ownership and assets. Work closely with your business broker, legal team and the buyer to facilitate a smooth transition. This could involve transferring ownership of shares or assets, updating contracts and licenses, notifying employees and stakeholders, and ensuring a seamless transfer of customer relationships and supplier contracts.

Through the transaction phase, it’s crucial to maintain open communication, transparency, and professionalism with the buyer and all involved parties. Working closely with Pacific Business Sales will help you navigate the complexities of the process and ensure a successful sale of your business.

How to Sell My Business: What Comes Next?

Even after the sale is completed, there could be post-sale transitions and contingencies to manage. This could include assisting the buyer with the integration process, providing transitional support or training, or addressing any post-closing obligations outlined in the purchase agreement. Be prepared to continue to collaborate with the buyer post closing to ensure a successful transition and address any unforeseen issues that might arise.

How to Sell My Business in California

Pacific Business Sales is here to help you sell your business in California. With over 20 years of experience as a business sales broker, your business will be in good hands when you work with us. We have worked with a variety of industry professionals from aerospace to healthcare. We are dedicated to helping you sell your business and get the results you need. Let us help you sell your business! Contact us today for a free market value analysis on how to sell my business in California.