The UCLA Anderson Economic Forecast for 2021 is looking very promising with projected GDP growth roaring back in the second quarter of 2021. California is expected to have higher growth than the rest of the nation and has a very good economic outlook for 2021 and 2022.

So why should you sell your business in 2021? Why not hold onto your business and cash in on another couple of “good years”. The answer is risk. While “essential” businesses continued to grow and had a good 2020, the overall economy was in the tank and consumers were taking a significant hit on income. 2021 is expected to have a big rebound as a result of pent-up demand and additional government stimulus. There will also likely be government spending on infrastructure to prop up the economy in 2021 and 2022. All of this is great news for the short term, but eventually, it will be time to pay the bills.

SBA Loan Incentive Program

SBA loans funded between February 1st, 2021 and September 30th, 2021 will have 6 months of loan forgiveness for the Buyer (no payments for 6 months and those payments forgiven), PLUS SBA is waiving the SBA guarantee fee of 3% for loans under $750,000 and 3.5% for loans over $750,000. This saves buyers $35,000 at closing on a $1 million loan!

For a buyer to take advantage of this the transaction must close BEFORE September 30th, 2021, so time is short!

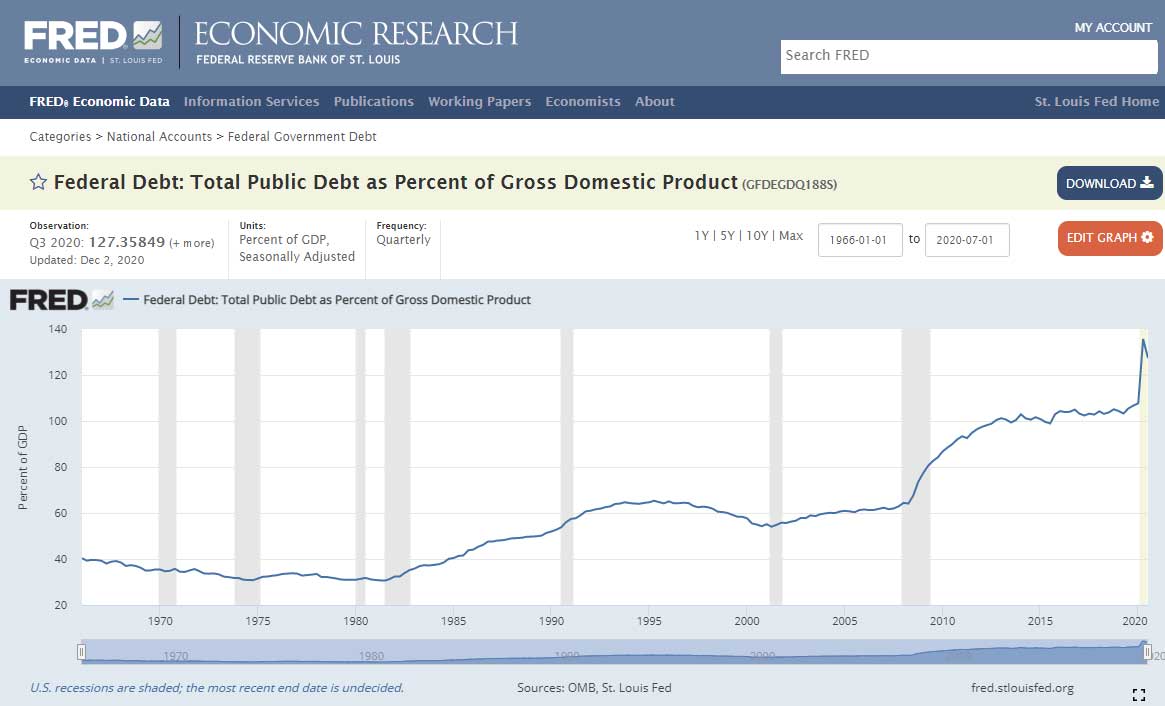

The US National Debt was 127% of US GDP in the third quarter of 2020 as reported by the St Louis Federal Reserve Bank. As you can see from the graph below, historically the national debt has been well below 70% until after 2000, and in 2020 the national debt exploded to 127% of GDP. Economically, this cannot last and will have to be attended to once the country and the economy has recovered from COVID-19.

National Debt 1996 through 2020 Q3

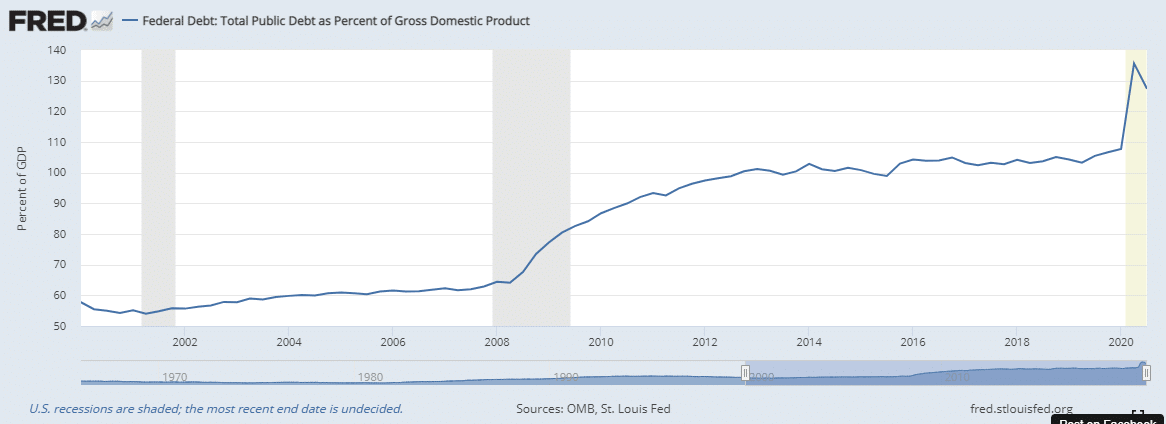

National Debt 2000 through 2020 Q3

Narrowing the timeline on the graph to 2000 through 2020 you can see the national debt was in the 60% range until the 2008 financial crisis and after that it increased to over 80%, hitting 100% by 2013. In 2020 it skyrocketed from just over 100% to a whopping 127%.

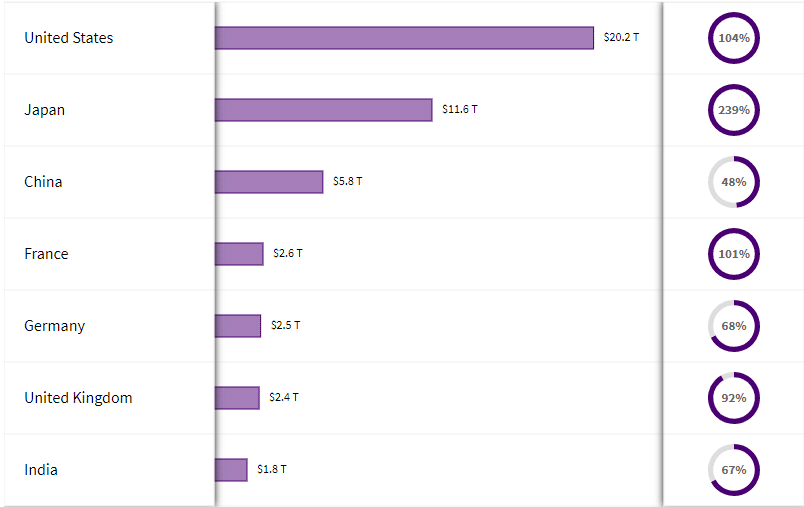

For a comparison of debt by country see the graph below (note this has the US debt is at 104% at the time of its publication). As you can see, the US debt as a percentage of GDP is nearly double that of Germany and China, and 20% higher than the UK.

When the US National Debt exceeds 90% of GDP it is an economic red flag and of great concern to economists. Of course this debt cannot be reduced during 2021 or probably even 2022 while the US economy is getting back on its feet along with the rest of the world after COVID, but eventually this debt will have to be dealt with. That means in all likelihood one would expect the government to cut spending, raise taxes, or both in 2023. When this happens the economy will likely stall after several years of growth through stimulus and government spending.

What this means for Business Owners

Based on 2021 being a big economic rebound, and the risk of this recovery being followed by a recession, this is a great time to sell your business, unless you are willing to take the risk, and ride out a prolonged recovery.

What Industries & Businesses are Best to Sell in 2021?

The businesses best positioned to take advantage of the 2021 economic rebound are essential businesses such as manufacturing, construction, e-commerce, healthcare, and B2B services that were either unaffected or minimally affected by COVID-19 in 2020.

These businesses will not have seen a reduction in their value from a drop in revenue and earnings in 2020 and are poised to show additional growth and stability in 2021. During 2020 these businesses were in high demand with buyers and were able to qualify for SBA financing making the acquisition even more attractive.

Businesses that Should Consider Delaying their Sale

Businesses that should consider waiting to sell are those that were severely affected economically by COVID-19. For example, restaurants, brick & mortar retail, and hospitality businesses that were severely affected throughout 2020, their recovery will be slow.

If your business is in one of these industries the value will have dropped dramatically as a result of the drop in revenue and earnings. In broad terms for every dollar your earnings dropped, the value of your business is decreased by $2 to $3 plus or minus. Thus a $100,000 drop in earnings is roughly a $200,000 to $300,000 hit to the value of your business.

If you can wait until your business recovers and the earnings and revenue are back on track you will be able to realize a much better value for your business. If you must sell in 2021, unfortunately, your business value will have decreased dramatically.