There are effectively two choices with respect to small and mid-size business purchase agreements. A buyer or seller can opt to have their attorney draft the purchase agreement from scratch or use a standardized purchase agreement such as the one created by the California Association of Business Brokers (CABB).

While some buyers may initially find comfort in using an attorney to draft a custom agreement for the transaction, the feeling will be gone when they receive the bill. The cost for an attorney to draft a purchase agreement or LOI will certainly be several thousand dollars and if there are revisions and amendments as a result of negotiations that bill will continue to climb. In one transaction in which the buyer insisted on using an attorney to draft an LOI and the purchase agreement their legal fees were over $40,000. While this is an extreme example, once they went down this path there was no turning back. The transaction was successful, just very expensive on their part.

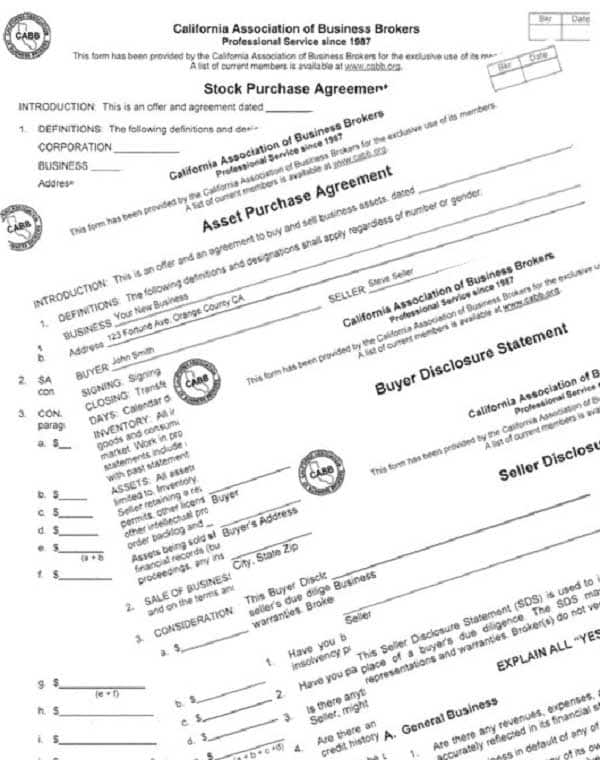

Thousands of businesses are sold every year and while each business is very different, the transaction process is the same. Much like CAR (California Association of Realtors) created standardized purchase agreements and associated forms for home sales, CABB (California Association of Business Brokers) has done the same for business sales. Professional Business Brokers throughout California use the CABB purchase agreement and the associated forms.

The CABB purchase agreements were drafted by attorneys who are Associate Members of CABB alongside CABB’s most experienced Business Brokers. Their objective was to produce standardized agreements for business sales likened to residential and commercial real estate purchase agreements produced by CAR and AIR (Association of Industrial Realtors).

Using the standardized agreements are advantageous in four ways

- The CABB forms and agreements are written to include the majority of components in an asset or stock sale and have protections built-in for both buyer and seller. The contracts are easily read and in the case of a stock sale form the foundation of the purchase agreement for your attorney to review rather than creating an entire document from scratch (which you are billed for). If you choose to use an attorney they can add an addendum with any additional terms or language they feel is required.

- If a buyer hires an attorney to write a LOI or purchase agreement the cost could become prohibitive especially if the LOI or purchase agreement is not accepted. Remember, while you have paid for that offer or LOI to be drafted, there is no assurance it will be accepted or if accepted the deal will go through. You will have a lot invested just to present an offer or LOI. If the terms are acceptable to the seller then the seller needs to engage their attorney to review before acceptance. And if the seller’s attorney comes back with revisions, then it goes back to your attorney to review the revisions, and perhaps counter some of the revisions. And on and on…

- If a custom purchase agreement, LOI or contract is written by an attorney the broker cannot give legal advice and has to advise both parties to seek advice from their attorneys. The legal costs can run into the thousands of dollars before the transaction begins, if it begins.

- Many attorneys are not familiar with the nuances in the small and midsize business sale transaction and leave important components out of the LOI or purchase agreement which again will add additional costs through amendments and review.

At Pacific Business Sales we use the standardized CABB forms and purchase agreements for practicality, consistency, and legal cost savings for the buyer and seller. The CABB forms and agreements are written by attorneys and experienced business brokers specifically for small-midsize business sales. We advise clients to have their attorney review the purchase agreements if they have any legal questions that would need to be addressed by an attorney.

Where an attorney is especially useful, and required, is preparing specific agreements such as a consulting agreement with the seller. We also recommend sellers have their attorney draft the seller note and security agreement.

At Pacific Business Sales our goal is making the transaction go in a smooth and timely manner. We walk buyers and sellers through the selling process from beginning to end, explaining every step of the transaction.