June 2024 Update

US Prime Rate still holding steady at 8.5% after June 2024 Fed meeting

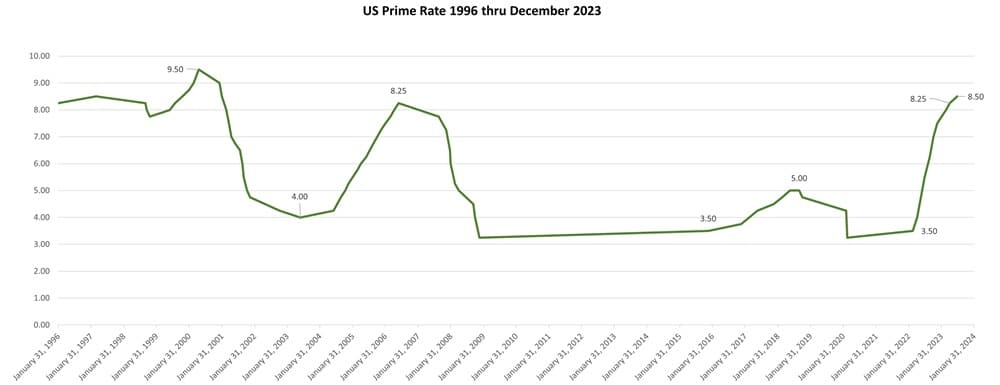

The Fed Rate remains unchanged after the June 2024 meeting, which left the US Prime rate unchanged at 8.5%, a 23-year high. This puts the maximum SBA 7a business acquisition loan at 11.5% (Prime+3%). With that said, few lenders are charging more than 11% and most are in the mid to high 10% range as of June 2024.

As of June 2024, we have one SBA lender offering 7.8 to 8.2% SBA 7a loans, with 10-year fixed rates which is the best rate we know of. The SBA lending market remains very competitive with banks looking to do more SBA loans to replace their shrinking residential real estate, commercial real estate, and consumer loans. So yes the rates are higher than in 2021, but banks are still lending and the market is competitive.

The July 2023 rate hike by the Federal Reserve was the 11th interest rate increase since the Fed waged war on inflation. The July rate hike immediately increased the Prime rate from 8.25% to 8.5%, which also increased the maximum SBA 7a loan rate to 11.5% (the maximum allowable SBA 7a loan rate is Prime + 3%). The Prime Rate has been holding steady since the July Fed Rate hike and most economists now predict the Fed would start easing rates in late 2024.

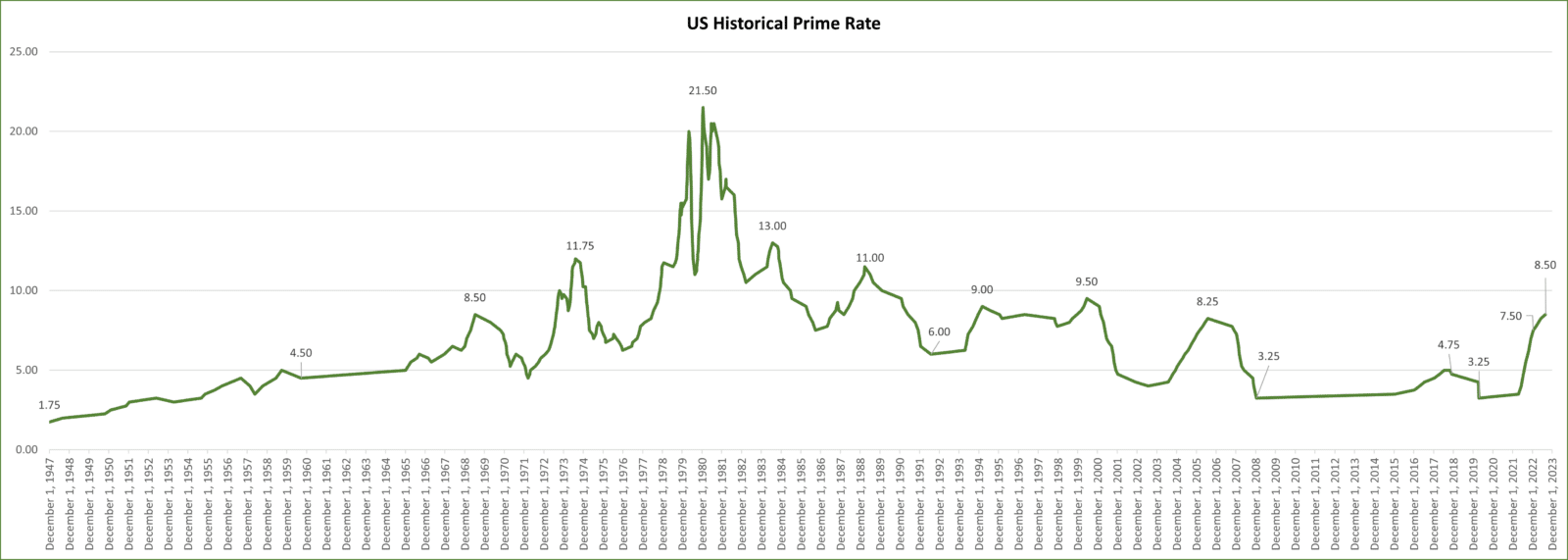

To put this in perspective, while the Prime Rate has indeed jumped from a historic low of 3.25% in 2020 to 8.5% as of July 2023, a Prime Rate of 8.5% is not a record high, but it is the highest Prime Rate since 2006.

The graph below shows the Historical US Prime Rate through December 2023.

How Do Increases in Interest Rates Affect Business Acquisitions?

As professional business brokers, we follow the prime rate and SBA loan rates closely. From March 2020 through March 2022 we enjoyed a prime rate at a historic low of 3.25%, which translated to a maximum SBA loan rate of just 6%. The last time the Prime rate dropped to 3.25% was in December 2008 and before that in 1955. Interest rates from 2020 through early 2022 were truly at historic lows; consequently, so were SBA and other business loans.

11 successive interest rate hikes by the Fed from March through July of 2023 raised the Prime Rate from 3.25% to 8.5%, with SBA loan rates increasing from 6% to between 9% and a maximum rate of 11.5%, which begs the question, will these rate increases affect business sales and business values?

The Maximum allowable SBA loan rate stands at 11.5% (Prime+3%) as of June 2024. With that said, none of the SBA PLP (Preferred Lender Program) banks we work with are charging this rate and most banks are charging from 9% to 10.5%, with one lender offering rates as low as 7.75% to 8.0% as of June 2024. The picture is not as bleak as the media is painting for small to mid-size business sales and acquisitions. As business brokers, we know this from our over 20 years of experience selling businesses with SBA financing. The increased interest rates increase debt service and lower the buyer’s net after debt service, but a solid transaction will still pencil out at the right price and terms.

The Acquisition Financing Perspective: Impact of a 1-Point Increase to SBA Loan Debt Service

Psychologically, we all react negatively to increases in interest rates. When we see news of the Fed raising interest rates by 0.25% or 0.5% in one bump, the immediate response is to assume the loan you are contemplating will cost a lot more money and maybe the deal you are working on won’t pencil out anymore. This is far from true.

The table below compares the effect of a 1-point (1%) increase in lending rates on $1 million, $3 million, and $5 million SBA business acquisition loans. As you can see in the example below, a 1-point increase in SBA lending rates on a $1 million loan increases debt service by approximately $500 annually. You can use $500 million loan value as a rough estimate. As you can see below, the approximation of $500 per million of loan value is a good estimate for the increase in debt service from a 1 point interest rate increase.

| Loan Value | $1 million | $3 million | $5 million |

| Annual Payment at 8% 10-year term | $12,133 | $36,398 | $60,664 |

| Annual Payment at 9% 10 year-term | $12,668 | $38,003 | $63,338 |

| Annual Payment at 10% 10 year-term | $13,215 | $39,645 | $66,075 |

| Annual Payment at 11% 10 year-term | $13,775 | $41,325 | $68,875 |

| Annual Cost Increase from 8% to 9% | $533/year | $1,605/year | $2,674/year |

| Annual Cost Increase from 9% to 10% | $527/year | $1,642/year | $2,737/year |

| Annual Cost Increase from 10% to 11% | $560/year | $1,680/year | $2,800/year |

Acquisitions and purchases of small to mid-sized businesses were steady when SBA rates were as high as 9%, and even above 10%, in the not-so-distant past, and we have been here before. But, if one looks at the impact of a 1-point increase in lending rates, it isn’t all that dramatic; and rate increases don’t make solid deals fall apart. The increased interest rates increase debt service and reduce the Net After Debt Service on deals. And yes, it may result in reduced values on some transactions where the debt service is tight. However, businesses with strong cash flow and growth will not be adversely affected.

Of course, it is disappointing and frustrating to see interest rates at a 23-year high and increased debt service; but, one has to remember that interest rates have increased from historic lows and will be returning to historically normal levels. A solid deal will still pencil out and make economic sense; and if it doesn’t, it is likely a weak deal.

Small and Mid-Sized Business Sales Survive Rate Increases Better than Wall Street

Business media may be full of stories about Wall Street M&A activity slowing as the rates increase, however, these are highly leveraged deals, with very tight cash flow, and counting on optimistic growth projections to generate the cash flow necessary to service the debt and make a profit. These deals will fall apart because there is no margin for increased lending costs, slower economic growth, or increased operating costs. It is likely, therefore, that we continue to see media attention on Wall Street, Fortune 500, and tech business sales and acquisitions.

Small and mid-sized businesses are generally not directly affected by these economic factors. Firstly, small & mid-size business acquisitions are not done on razor-thin deal margins. The banks won’t underwrite the deal and a small business buyer would never take that level of risk. Secondly, Wall Street and big companies are subject to the wild swings of the stock market as well as the overall economy. Many small businesses continue to thrive when the general economy slows. Case in point, while the general economy struggled in 2020 due to COVID, many of the businesses we sold had strong years in 2020 and 2021, and have continued to prosper through 2024. Small business financial performance doesn’t necessarily follow the stock market.

The bottom line is that if the deal and company are solid, it will survive the upcoming higher interest rates, and the effect will be minimal.

For more information about selling your business contact us. Pacific Business Sales specializes in the sale of industrial businesses including manufacturing, technology companies, 3PL, construction, healthcare, e-commerce, and aerospace companies. Our team of professional business brokers will guide you through the process of selling your business, working closely with you to ensure the best outcome.