Update on Small & Midsize Business Sales & Lower Middle M&A Market

Updated August 28th, 2025

BizBuySell 2025 Q2 Small-Midsize Business Sales Market Insights Report:

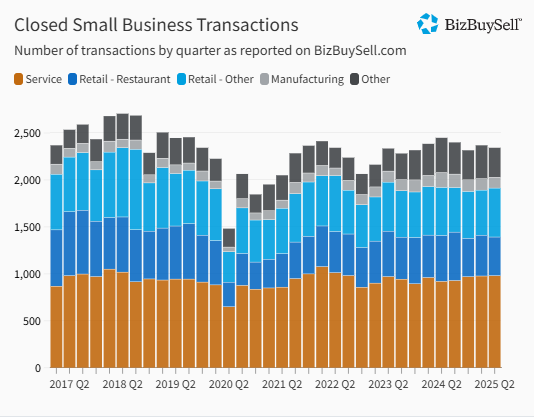

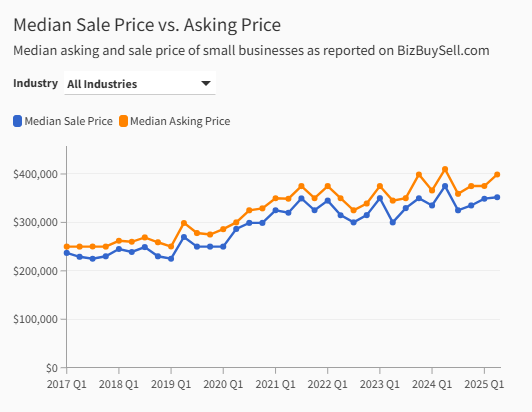

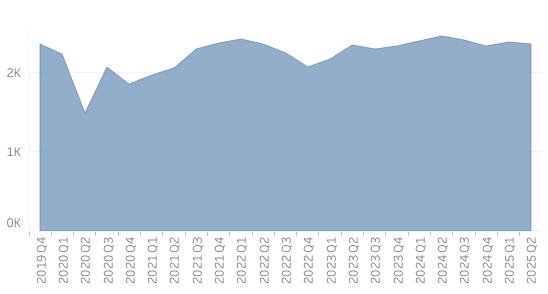

After a strong Q1, 2025 small & midsize business sale transactions (number of transactions) slowed modestly in 2025 Q2, while the median sale and asking price for businesses increased over 2025 Q1 (see charts below). Interestingly, Median Sale and Asking Prices both continued to trend upward, despite the modest slowdown in transaction (sales) volume.

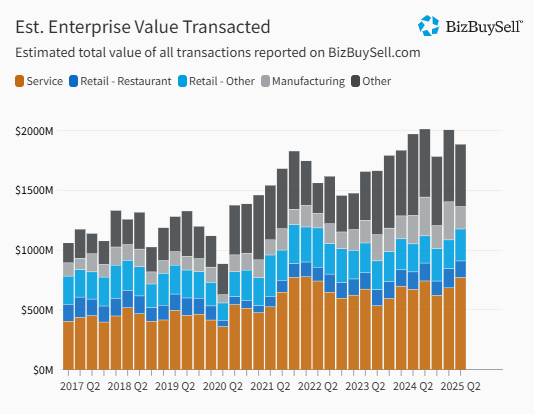

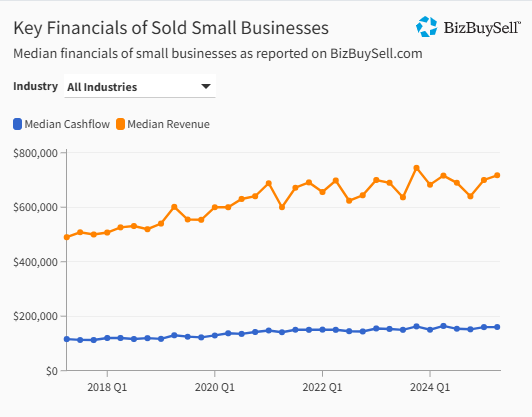

Total transaction value in 2025 Q2 dropped as a result of the decline in transactions; however, the increase in transaction values and a modest increase in earnings multiples softened the impact. Key Financials of businesses sold also continued on its upward trend in 2025 Q2.

Overall, 2025 Q2 had strong performance and buyers remain optimistic about acquisitions (see below).

Although 2025 Q2 total enterprise value sold dropped (chart below) as a result of the drop in the number of transactions, the median sale vs asking price (see chart below) increased, as did the Key Financials of Businesses Sold continue to trend upward (chart below)

The drop in the number of transactions drove total enterprise value transacted downward.

Key Financials of Sold businesses in 2025 Q2 increased despite the slight decrease in the number of transactions.

Despite the modest decline in the number of transactions from 2025 Q1, transaction volume is relatively flat historically.

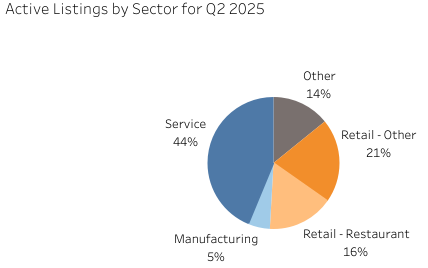

Note: The BizBuySell Insights charts shown include data for all transactions, which include a wide variety of businesses ranging from main-street businesses to manufacturing companies.

2025 Small & Mid-Size Business for Sale Outlook

The overall small and mid-size business for sale market continues to show solid performance and resilience in 2025. Despite no interest rate cuts from the Federal Reserve and consequently, no rate reductions in SBA loans, since December of 2024, SBA lending activity remains steady. We have seen underwriting and credit policies tighting with SBA lenders looking for both stronger financial performance from the target business and stronger buyer experience and capital.

The posbility of an interest rate cut in September is looking better as a result of the weak July jobs report (see below), however, stronger than expected GDP growth in July could crush these hopes, as the Fed is carefully watching for signs of inflation.

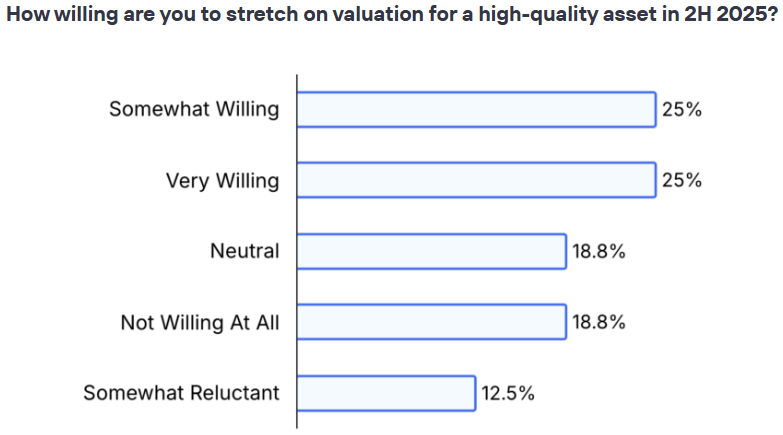

Buyers Remain Optimistic & Engaged in Second Half of 2025

The data below is from the Axial.net Middle Market Review & Survey.

- 93% of buyers expect to close deals in 2025

- 50% of buyers are either somewhat willing or very willing to stretch their valuation for a high-quality deal

- Only 19% of buyers are not willing to stretch on their valuation to win a deal

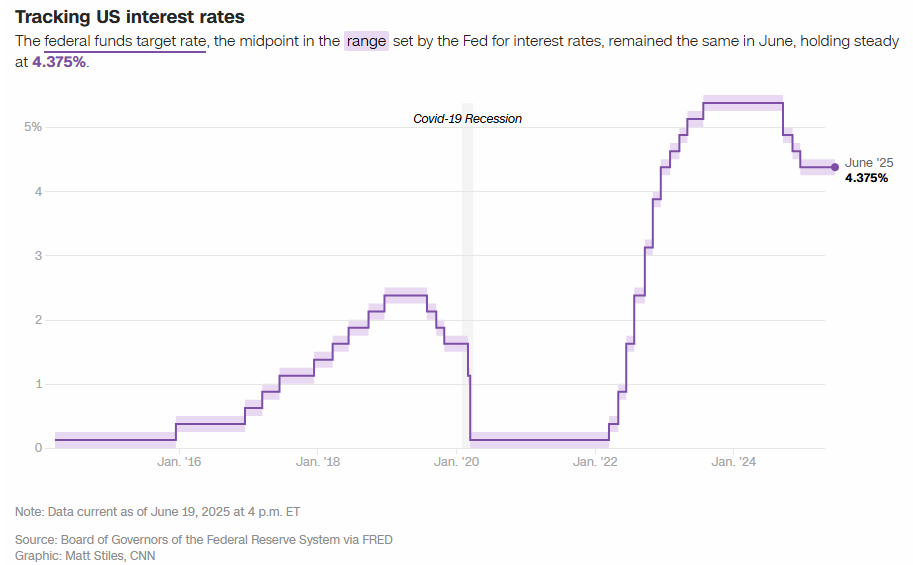

Update on Fed Rates as of August 28th, 2025 and SBA Interest Rates

Following the July 21st, 2025 Federal Reserve meeting, Chairman J Powell announced the Fed Funds rate will remain unchanged at 4.25% to 4.52% where it has hovered since December 2024. There were two dissenting votes on leaving the rate unchanged, stating openly now is the time to lower interest rates. Ironically, days after the official announcementcement of leaving rates unchanged, the July jobs report was released with the worst performance since December of 2020!

The July jobs report showed just 73,000 jobs added, with May and June revised downward by 258,000 jobs. After the weak jobs report Chairman J Powell indicated a rate cut is likely coming in September.

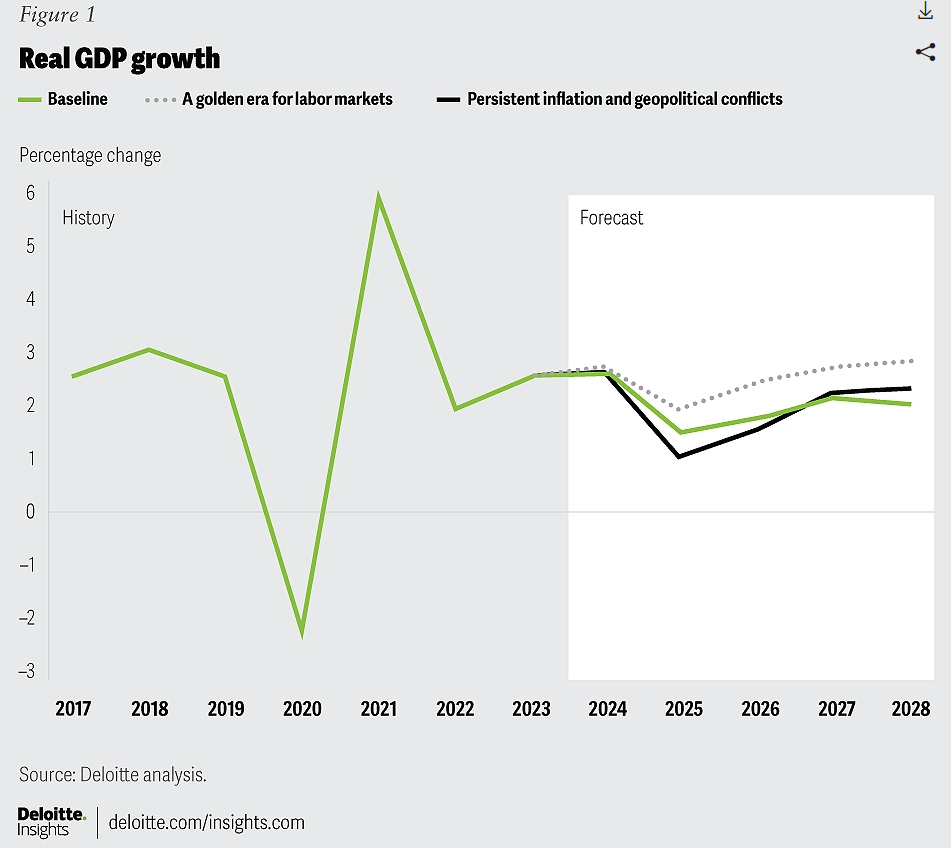

Second Quarter 2025 GDP numbers rebounded much stronger than expected showing 3.3% annual growth, a resounding rebound from the negative 0.5% in Q1. This further complicates the decision for a rate cut in September, with the GDP climbing and jobs declining.

The Fed indicated two rate cuts are still possible for 2025, but US economy is unpredictable due to the still unknown impact of tariffs and the contradictory risks of inflation or stagflation.

Read more Divided Fed Still Worried About Tarriffs, Inflatoin, & the Labor Market CNBC

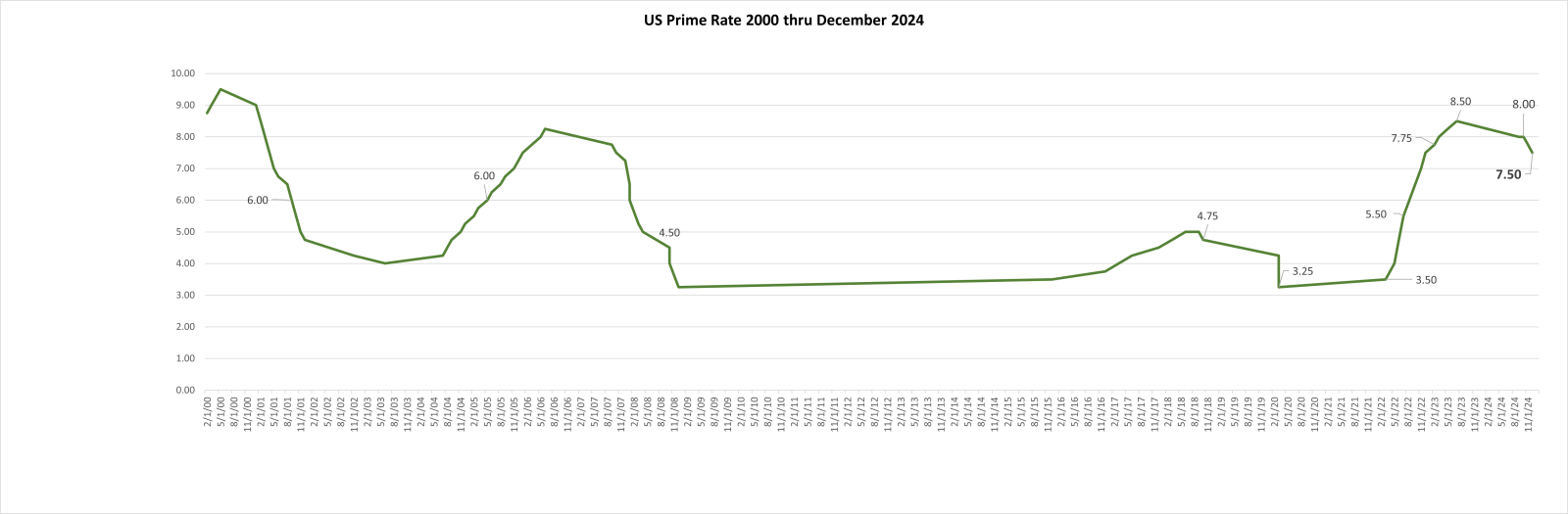

Note that the rates below are Fed interest rates, and most SBA loans are based on the Prime Rate, which generally follows the Fed Rate and is slightly higher (see below).

Read more:

Read FOMC (Federal Open Market Committee) Summary of Fed Funds Rate Projection

Link to chart showing the Historical US Prime Rate from 1947 to November 2024

Source data for chart above JP Morgan Chase Historical Prime Rate

While the maximum SBA interest rate is now 10.5%, few lenders are charging the maximum rate due to the competitive lending market. We expect most lenders to offer SBA loan rates between 9.75% and 10.25% variable rates over 10 years. We have one lender offering 10-year fixed-rate loans at 8.1% to 8.5% for qualified buyers and businesses. (these rates vary with the current 10-year treasury rate).

2025 US Economy Projections Updated November 2024

The Deloitte 2024 Q3 Economic Forecast provides excellent insights into the 2025 US economy. Deloitte is projecting slowing, but modest GDP growth in 2025 with increasing GDP growth in 2026 through 2028.

- GDP Growth slowing in 2025, but trending up through 2028

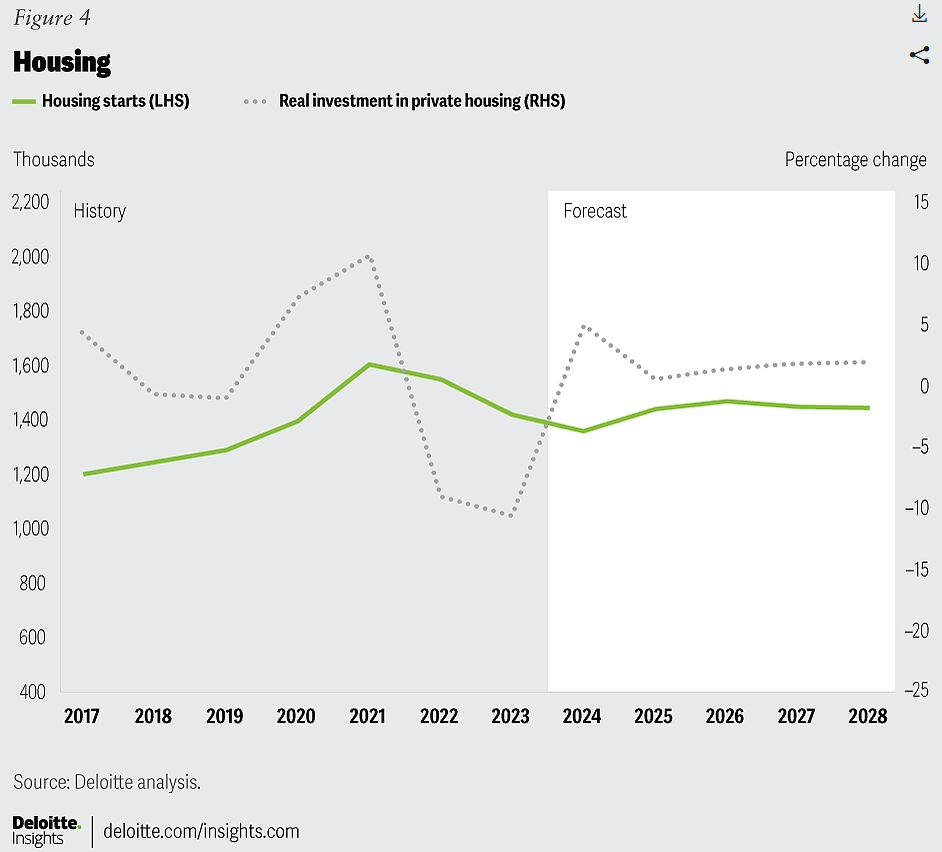

- Housing Starts increasing from the decline in 2021 through 2024, and modest growth in 2025 & 2026

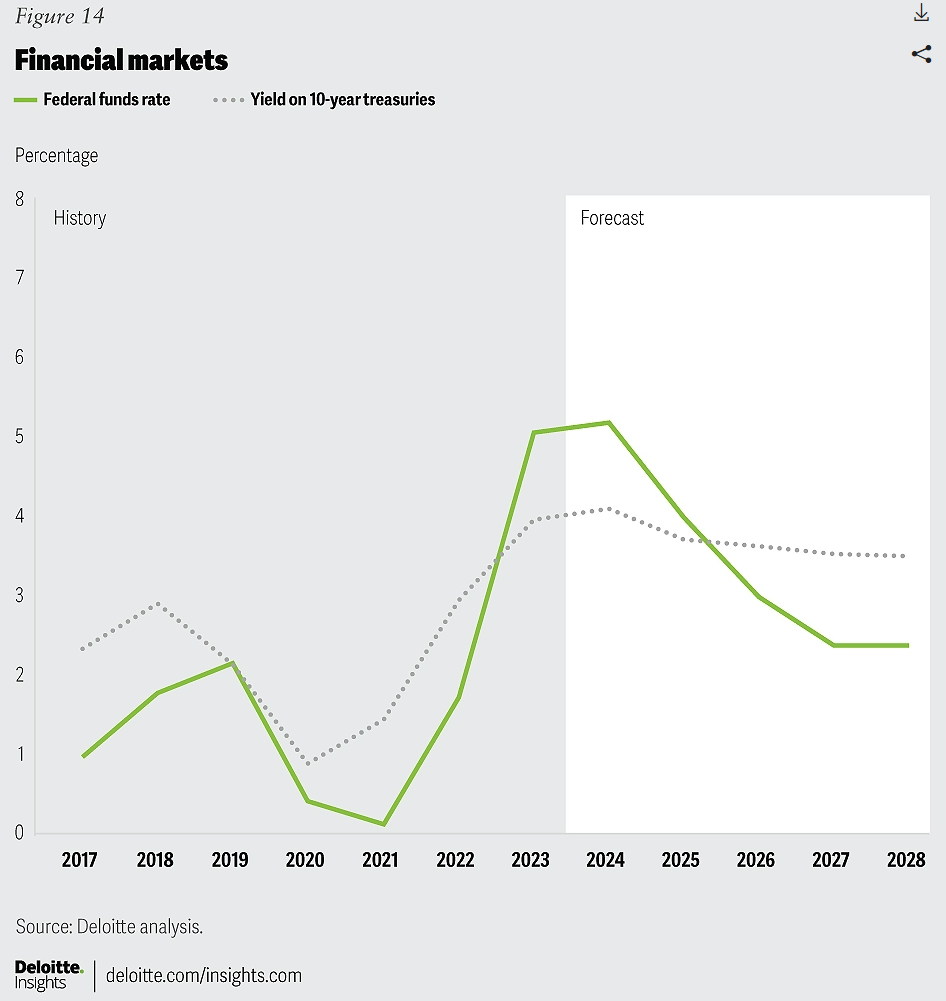

- Fed Funds Rate is projected to continue a downward trend through 2027 and level off

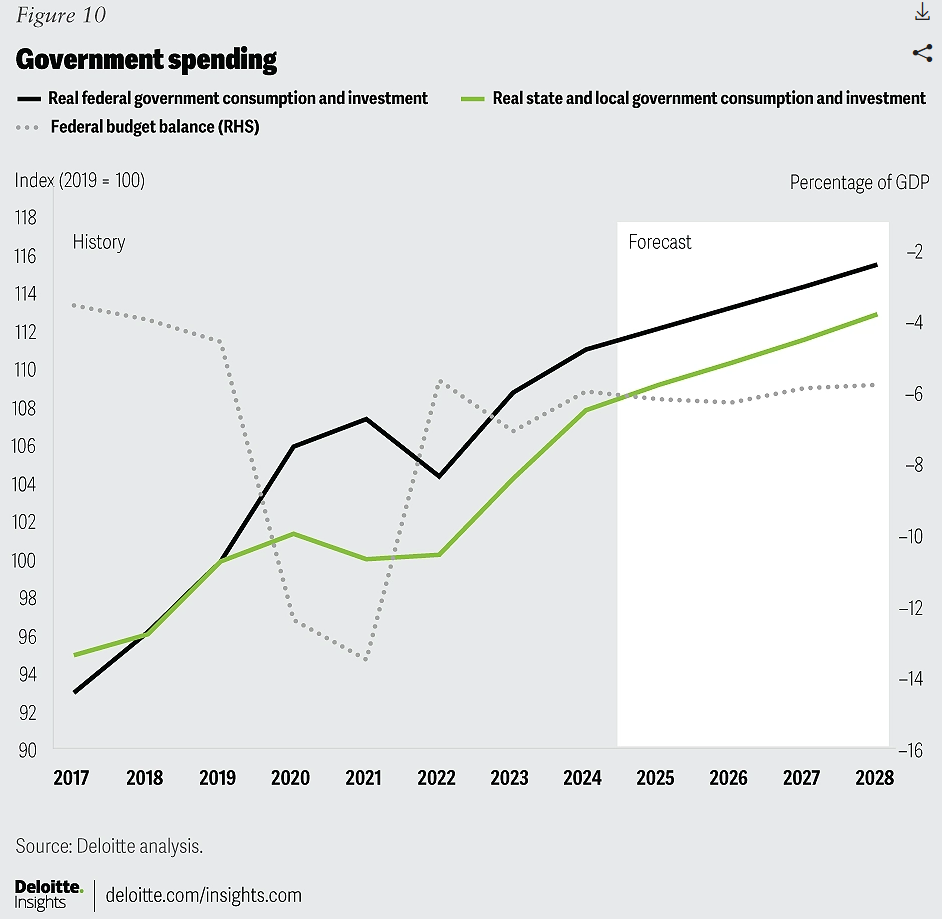

- US Government Spending projected to have steady growth through 2028

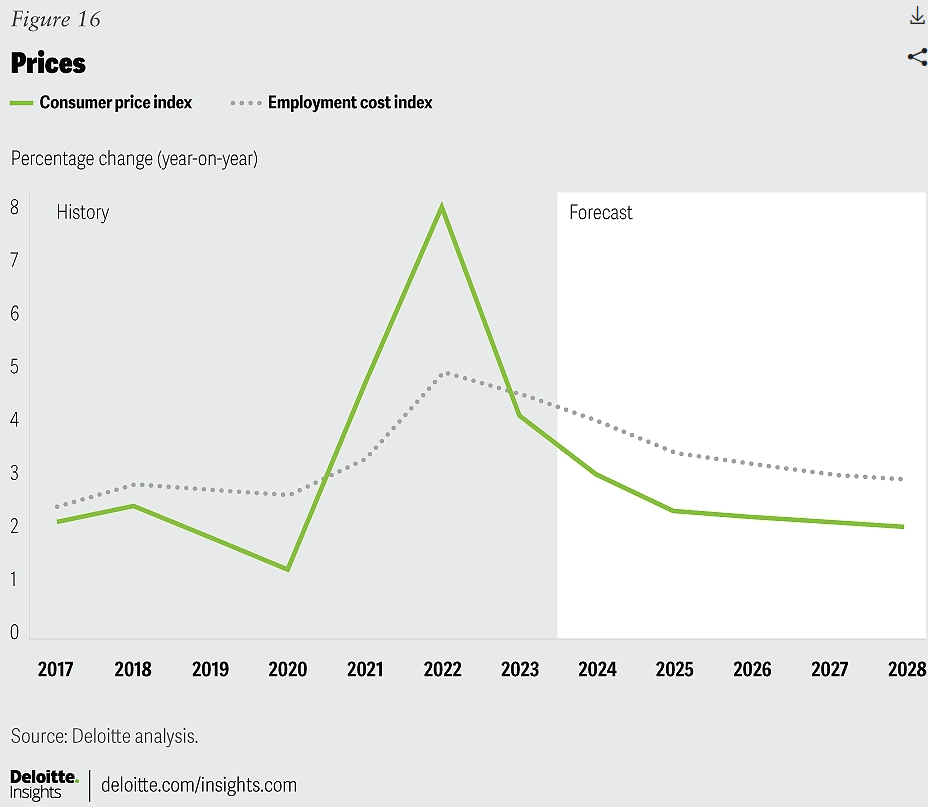

- Consumer Price and Employment Cost indexes are projected to continue to show lower inflation in 2025 leveling off to normal levels in 2026.

Read the full Deloitte 2024 Q3 US Economic Forecast

2025 Housing starts are projected to increase slightly with investment in private housing increasing. It is important to note that Housing Starts reflects single-family home construction and does not reflect multi-unit, commercial, or home remodeling construction. Thus, the chart below only shows new home construction trends.

Deloitte is projecting a steady reduction in the Fed Funds rate through the end of 2026 which will result in further rate decreases in the Prime Rate and consequently SBA loan rates through 2026. This is good new for buyers and business owners with variable-rate SBA loans.

Government spending is projected to increase steadily in 2025 and through 2028 which should be good news for Aerospace and Defense contractors and manufacturing businesses.

Consumer Price and Employment Cost index increases are projected to continue to slow from the 2022 peak through 2025, leveling off to normal inflation rates in 2026 through 2028.

2025 M&A and Small-Midsize Business Sale Outlook

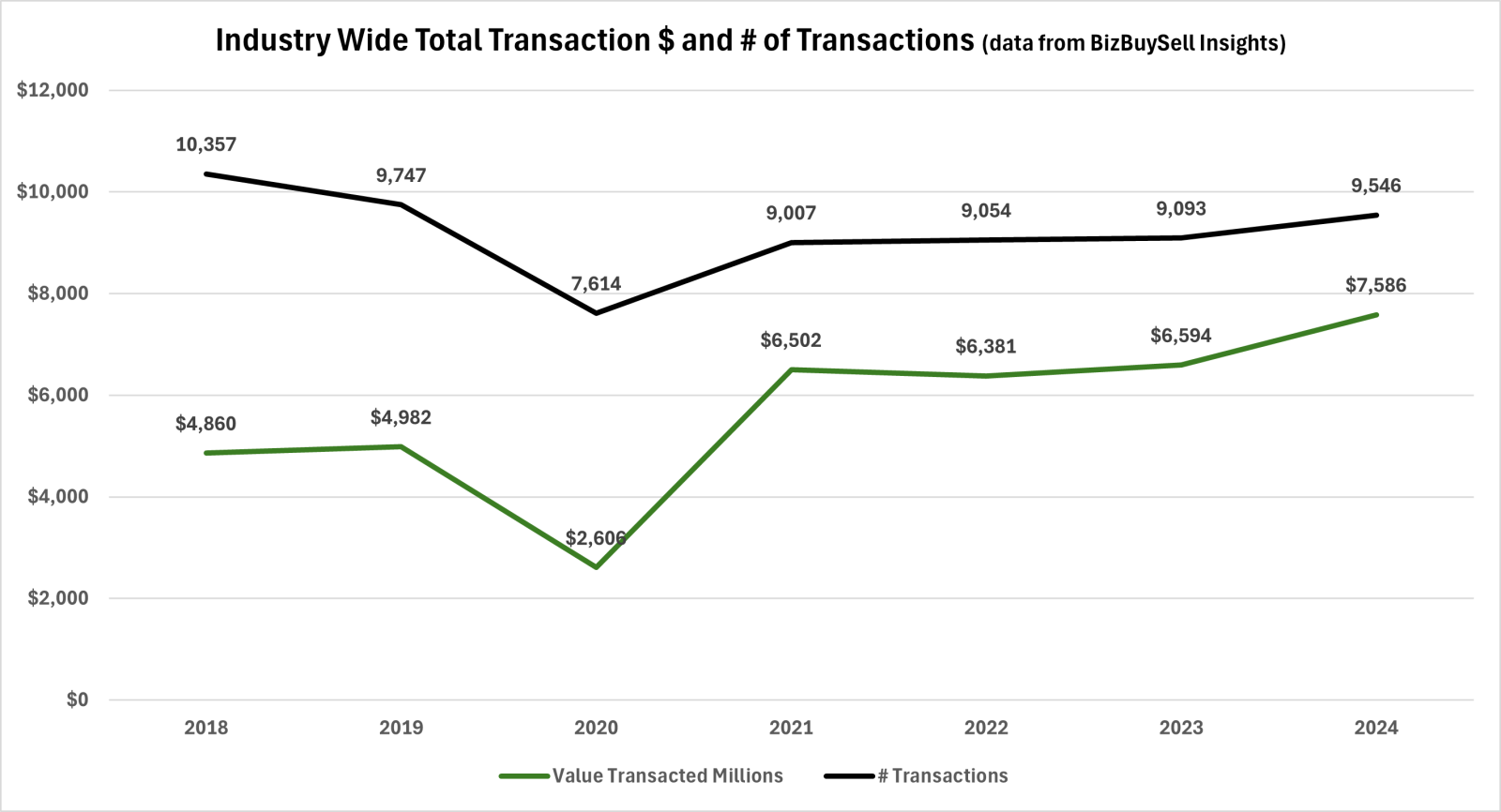

Transaction volume (number of business sales) and transaction values have steadily increased since 2023. With SBA loan rates dropping and overall business financial performance improving, 2025 looks to be a good year for owners wanting to sell their businesses and buyers looking for businesses to buy.

We expect industrial businesses such as B2B services, distribution & 3PL, manufacturing, and construction-contractor businesses to have an excellent 2025 for business sales (transaction) activity and values. Service businesses such as Plumbing, HVAC, and Electrical were in high demand in 2024 and will continue through 2025 as a result of increased acquisition activity by Private Equity.

Retail, restaurants, and hospitality businesses are still recovering and not expected to see significant increases in deal activity or valuations, but they are recovering and on a slow upward trend.

What does all this mean for Small & Mid Size Business Sales & Business Valuations?

Business valuations are driven by earnings, specifically Discretionary Earnings and EBITDA. While business revenues and earnings vary, the multiples of earnings (DE & EBITDA) do not change much. Valuation multiples vary by industry type and business size, but within an industry, they don’t fluctuate much over time or with the economy. Thus your company value is determined by its financial performance, and not Wall Street or even the overall economy.

As an example, during the pandemic retail, hospitality, and travel businesses suffered greatly, while construction, manufacturing, and industrial businesses continued to thrive and business sales in these sectors performed well during and after the COVID pandemic.

Businesses with good financial performance throughout 2023 and 2024 and going into 2025 can expect good valuations and good demand if they go to market in 2025.

Businesses with declining sales and earnings will be difficult to sell and if sold can expect discounted valuations.

While the above is always true, it is especially true now because of the economy, interest rates, and general concerns about companies recovering from the pandemic and economic turmoil of recent years.

Connect With Orange County & California Business Broker Experts

Pacific Business Sales stands as a leading business brokerage firm headquartered in Orange County, serving clients across California with expertise in both asset sales and stock sales, including businesses with licensing. With a dedicated network of financial advisors and other business consultants, we specialize in implementing tax strategies and deal structures aimed at minimizing taxes on business sales. For a consultation or more information on our services, contact us and speak with one of our professionals today.