How will the 2024 economy and declining interest rates affect small businesses and the M&A market?

Updated September 19th, 2024 after J Powell announced a 1/2% cut in the Fed Rate

Federal Reserve Chairman J Powell’s announcement of a rate cut at the September 18th press conference following the September Federal Reserve board meeting was expected, and while many economists hoped for a 1/2 point cut, most expected a 1/4 point cut. Needless to say, J Powell’s announcement of a 1/2 point rate cut was cheered across the financial markets, real estate markets, and industry. With the Fed on a stated course of lowering rates to reignite the US economy, fears of a recession are easing.

Read Federal Reserve Official Press Release Sept 18th, 2024

Read FOMC (Federal Open Market Committee) Summary of Fed Funds Rate Projection

Read AP Federal Reserve Signals End to Inflation with a Half Point Rate Cut

Link to chart showing the Historical US Prime Rate from 1947 to September 2024

Source data for Chart above JP Morgan Chase Historical Prime Rate

The Fed left interest rates unchanged from July of 2023 with the Prime remaining at 8.5% through September 18th 202 when the Fed rate was reduced by 1/2 point and the prime rate immediately followed suite dropping form 8.5% to 8%.

Economists are projecting two additional interest rate cuts of 0.25% in the second half of 2024.

SBA lending has remained active throughout the rate increases starting in July of 2023, and SBA lending rates will follow the reduction in the Prime Rate, dropping by 1/2 point in September of 2024. This will lower the maximum SBA loan rate from 11.5% to 11.0%.

While the maximum rate is now 11.0%, few lenders are charging the maximum rate due to the competitive lending market. We expect most lenders to offer SBA loan rates between 10.5% and 10.75% variable rates over 10 years. We have a lender offering 10-year fixed-rate loans at 8.0% to 8.25% for qualified buyers and businesses.

Despite the fluctuating nature of Wall Street during 2023 and early 2024, small and mid-sized enterprises continue to enjoy a prosperous period, with financial metrics, business valuations, and business sale transactions painting a favorable picture as 2024 progresses. As Orange County and California business brokers, our experience reflects the same trend.

BizBuySell 2024 Q2 Market Insights Report: Transactions Up, Median Revenue Up, Median Selling Price Up, Earnings Multiples Holding Steady

BizBuySell released the 2024 Q2 Market Insight report and it’s all good news for small and mid-size business sales. The 2024 2nd Quarter BizBuySell Insight Report shows small business acquisition transactions up by 5% from 2023 and the median asking and selling prices for small businesses continue to steadily trend upward. Median sale prices are up 25% year-over-year after a 13% drop in 2022, with median business revenue and earnings both increasing.

According to BizBuySells’ recent survey, 24% of buyers are waiting for interest rates to decrease, but 3 out of 4 are still actively on the hunt for a business, as evidenced by the % increase in closed transactions.

note: The BizBuySell Insights charts below include data for all transactions, which include a wide variety of businesses ranging from main-street businesses to manufacturing companies.

- Manufacturing business values-prices jump 31%

- Service sector business prices increase 17%

- Retail sector slows

- 42% of business buyers say business performance is the most important factor

- 67% of owners say increased costs have led them to increase prices

- 65% of owners say customer responses to price increases have been neutral

- 37% of owners expect their business value to increase over the next 12 months

2024 US Economy & Business Sales Second Half Update Updated June 2024

Projections from top economists for the US economy in the second half of 2024 continue to be upbeat. The economy is projected to continue to grow at a modest rate in 2024 and throughout 2025. Inflation is slowing, but still above the Fed’s target rate, which is expected to delay rate cuts, but is not expected to result in further interest rate hikes.

In the June meeting, the Fed left interest rates unchanged from July of 2023 and the Prime remains at 8.5%. Projections for interest rate cuts have changed from three 0.25% rate cuts in the second half of 2024 to one 0.25% rate cut in late 2024, and further rate cuts in 2025.

Despite the fluctuating nature of Wall Street during 2023 and early 2024, small and mid-sized enterprises continue to enjoy a prosperous period, with financial metrics, business valuations, and business sale transactions painting a favorable picture as 2024 progresses. As Orange County and California business brokers, our experience reflects the same trend.

What does all this mean for Small & Mid Size Business Sales & Business Valuations?

Business sales & acquisitions transactions increased by 10% in the first quarter of 2024, with median values steadily increasing from 2020 through Q1 2024 (see BizBuySell Insights report below). The second quarter of 2024 BizBuySell Market Insights report will be available in late July or early August and we will update this blog with that data when available.

Seller activity for selling businesses and Buyer activity for business acquisitions both increased in the second quarter of 2024. With interest rate reductions expected in the second half of 2024, we expect buyer acquisition activity to continue to increase through Q4 of 2024.

Most SBA loan rates are tied to the Prime Rate with a maximum rate of Prime + 3% which would put the current maximum SBA 7a business acquisition loan rate at 11.0%. With that said, very few SBA lenders are charging the maximum rate because the SBA loan market has remained very competitive. Most lenders are offering rates in the low to mid 10% range for 10-year variable rate loans. We have one SBA lender offering 10-year fixed-rate loans in the 8% to 8.25% range as of September 2024 for highly qualified buyers.

Are Higher Interest Rates Affecting Business Value and SBA Lender Approvals?

With interest rates at a 23-year high, debt service for acquisitions (business sales) has come under more scrutiny by SBA lenders. Businesses with lower Discretionary Earnings (DE)/EBITDA have become more difficult to obtain SBA financing for Buyers, while those with higher DE & EBITDA and well-qualified buyers are consistently being approved for SBA financing.

Increased interest rates have not affected business earnings multiples directly, but are affecting the business values of smaller businesses and those with lower earnings.

2024 Second Half Economic Forecast Updates from Deloitte, S&P, & The Conference Board

The updated 2024 US Economic Forecast from Deloitte remains optimistic for 2024 after a solid 1st half with 70% of the economy showing overall strength, demonstrating a broad-based recovery. Deloitte is projected Fed Rate cuts in late 2024 and GDP growth of 2.4% for 2024, followed by 1.4% growth in 2025.

S&P’s US economic outlook from March 2024 is projecting GDP growth of 2.5% for 2024 and inflation remaining above the Fed target of 2% throughout 2024. S&P still expects rate cuts from the Fed as early as late summer and possibly rate cuts of 75 bps (basis points or 0.75%0, with 125 bps reduction projected 2025.

The Conference Board is projecting no recession in 2024, despite slowing consumer spending and the economy cooling. The Conference Board’s projections are more conservative than Deloitte’s and S&Ps, with consumer spending expected to cool further and overall GDP growth to be under 1% over Q2 and Q3 in 2024. They expect inflation to normalize to the 2% Fed target in 2025 with the GDP increasing 2% in 2025 and interest rates starting to decline in late 2024.

See our Blog for information on Interest Rate Effects on SBA 7a Business Acquisition Financing

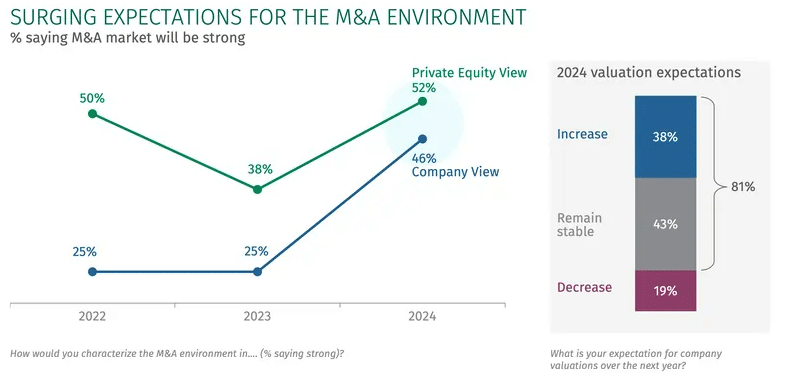

The Citizens 2024 M&A outlook is good news for M&A and business sales as it boasted promising tidings for M&A and business sale transactions, signaling a substantial surge in market expectations from both Private Equity firms and businesses alike. Private Equity anticipates a notable uptick in the M&A landscape, rising from 38% in 2023 to 52% in 2024, while businesses’ perspective on M&A activity skyrocketed from 25% in 2023 to an impressive 466% in 2024. This shared optimism from both sides of the M&A spectrum underscores the high expectations set for the year ahead.

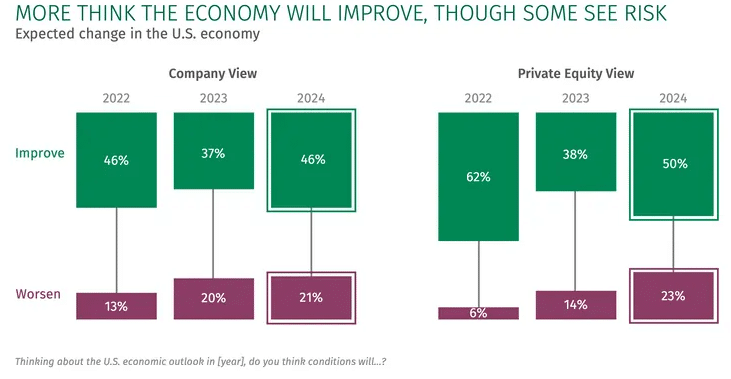

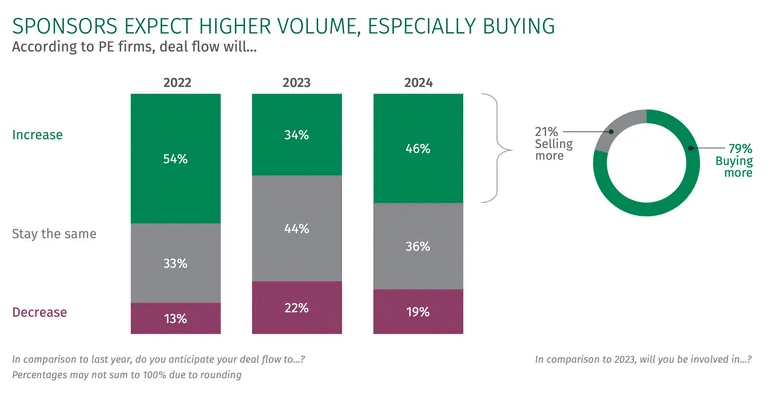

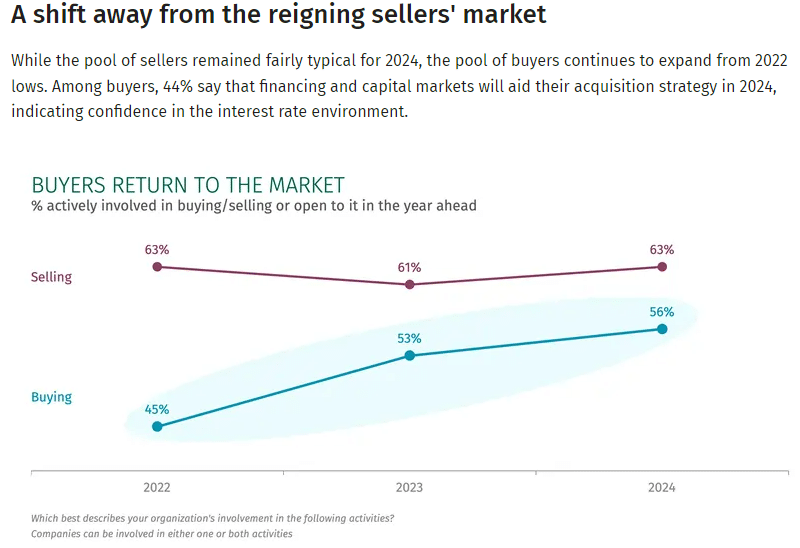

The Citizens 2024 M&A outlook has some especially helpful charts illustrating 2024 expectations from Private Equity this year.

- Private Equity & Businesses Expect a Strong 2024

- Private Equity & Businesses Expect the 2024 Economy to improve

- Most Expect the Economy to Improve

- PE Groups Expect Higher Transaction Volume

- Buyers are Returning to the Market

Additionally, Goldman Sachs is projecting the US GDP to grow 2.1 % in 2024, with 2% consumption growth, and a rate cut from the Fed in late 2024.

Read Goldman Sachs 2024 outlook here: Goldman Sachs 2024 US Economic Outlook

Better than expected 2023 financial performance led to Wells Fargo changing their 2024 economic forecast to a much brighter one with economic expansion now forecast through the end of 2025. Wells also expects the Fed to reduce interest rates by 125 bps (1.25%) by the end of 2025 with the first rate cut projected to be in May 2024.

Read the Wells-Fargo 2024 economic forecast here: Wells Fargo 2024 US Economic Outlook

The JP Morgan 2024 forecast also forecasts about 2% growth in 2024 with the Fed ending the rate hiking cycle and starting to ease rates in June 2024. JP Morgan expects inflation to run just above the Feds 2% target during 2024 and roughly 4% unemployment. Overall, JP Morgan expects 2024 to be an uneventful and boring 2024, a pleasant change from the turbulent 2023.

Read JP Morgan 2024 US Economy Outlook: 2024 Year Ahead Outlook; The Last Leg on the Long Road to Normal

2024 M&A and Small-Midsize Business Sale Outlook

Throughout 2023, the Fed was battling inflation with persistent interest rate hikes resulting in a Prime Rate of 8.5% at year end. Despite the rate increases, 2023 was a good year for small and mid-sized businesses as well as M&A and business sale transactions. 2024 projections for M&A and small to mid-size business sales are optimistic as are the forecasts for the 2024 economy. While 2024 isn’t expected to be a blockbuster year, it is expected to steadily improve and interest rates are expected to start coming down mid-year.

What does this mean to small businesses and the sales acquisitions of small and mid-sized businesses? Is 2024 still a good time to buy or sell a business?

In short, we expect 2024 to be an excellent year for business sales and acquisitions, with some caveats for specific industries.

- Business sales-acquisitions for businesses with solid financial performance continued to be strong in 2023 and we see that trend continuing into 2024. In fact, businesses with strong financial performance have been in very high demand.

- Business sales for very small businesses with weaker financial performance was slow in 2023 and we do not see this improving in 2024.

- SBA lenders were very active in 2023 and we see SBA lending continuing to be our primary funding source for deals under $5 million in value.

- Increased SBA lending interest rates have driven up debt service costs on acquisitions which reduced net after-debt service for buyers. However, we have lenders offering SBA 7a rates below the maximum rate which results in lower debt service for buyers and has kept SBA loan competitive.

- Business values for industrial, manufacturing, construction, and healthcare are holding steady and unaffected by interest rate increases and the economy.

- Industrial, manufacturing, and construction businesses unrelated to new homes continue to see steady profits and growth coming into 2024.

- Retail, food service, and hospitality businesses saw mixed results in 2023 with some recovering and others wrestling with increases in labor and Cost of Goods Sold which are squeezing margins. We expect much the same in 2024.

With the increased in SBA lending rates do deals still pencil out and make sense?

It was disappointing to see interest rates increase throughout 2023 and drive up the debt service for business sale transactions. Despite the steady rate hikes in 2023, Pacific Business Sales successfully obtained SBA financing on 90% of our transactions with our preferred SBA lenders offering rates well below the SBA maximum rate.

The prime rate has held steady since July 27th, 2023 and as of July 2024, SBA lending continues to be very active. We expect our historical trend of SBA financing to continue. Fed rate cuts are now expected in September 2024 will certainly invigorate the SBA lending market and will lead to increased small and midsize business sales activity.

Connect With Orange County & California Business Broker Experts

Pacific Business Sales stands as a leading business brokerage firm headquartered in Orange County, serving clients across California with expertise in both asset sales and stock sales, including businesses with licensing. With a dedicated network of financial advisors and other business consultants, we specialize in implementing tax strategies and deal structures aimed at minimizing taxes on business sales. For a consultation or more information on our services, contact us and speak with one of our professionals today.