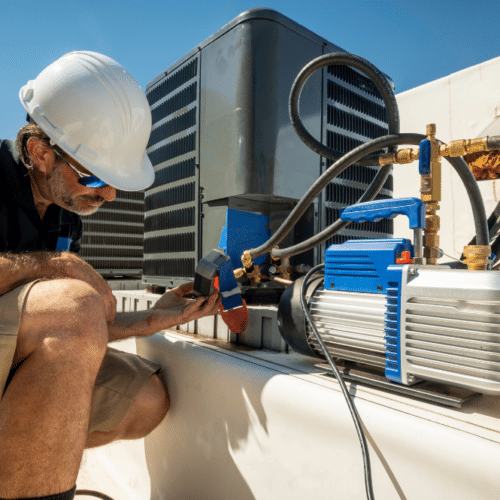

Sell My HVAC Business: Common Mistakes to Avoid

At Pacific Business Sales, we understand your HVAC business is not just a venture; it's a culmination of years of hard work, dedication, and expertise. When the time comes to…

Learn MoreFiltered by: selling your business

At Pacific Business Sales, we understand your HVAC business is not just a venture; it's a culmination of years of hard work, dedication, and expertise. When the time comes to…

Learn More

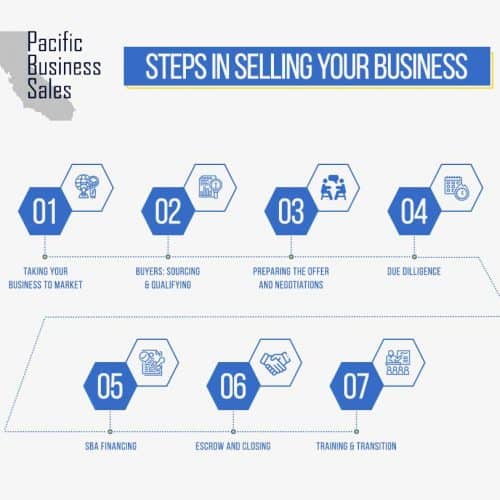

You built a successful business and now are thinking about cashing out to enjoy your retirement or start a new venture. Business owners who want to sell their businesses find…

Learn More

Manufacturing businesses are very different and more complex than most businesses. Manufacturing business financial statements are more complex with COGS (Cost of Goods Sold) that include inventory, and WIP (Work…

Learn More

The United States is home to thousands of private equity firms, a number estimated to be over 4,500, along with more than 14,000 private investment firms. In 2022, the private…

Learn More

In the realm of business sales, the role of business brokers is paramount. Acting as intermediaries between buyers and sellers, business brokers facilitate a myriad of deals across various industries.…

Learn More

Selling a business is not a small decision. There are a number of things to consider when you think about selling your business. Perhaps, it took you a while to…

Learn More

Selling a construction company is a major decision and milestone that requires careful planning and execution. Whether you are looking to retire, pursue new ventures, or simply want to move…

Learn More

What is a Search Fund? A search fund is an entrepreneurial investment model where an aspiring entrepreneur, known as the searcher, raises funds from investors to finance their search for…

Learn More

Bill Grunau has been a business broker for over 20 years and as the founder of Pacific Business Sales. Recently, he did an informative podcast with Mark Imperial of the Business Innovators Magazine.…

Learn More

Update on Small & Midsize Business Sales & Lower Middle M&A Market Updated August 28th, 2025 BizBuySell 2025 Q2 Small-Midsize Business Sales Market Insights Report: After a strong Q1, 2025…

Learn More| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |